As primary care practices navigate the choices offered by ACO REACH, they encounter an important factor to consider within the Global program: the Performance Year Discount. Let’s explore the impact of this discount and what it means for participants.

CMS has outlined a discount that will be applied to the benchmark for REACH ACOs in the Global track. This discount recognizes the efficiencies that ACOs generally achieve through extended participation in value-based care programs. It starts at a 2% discount for Performance Years 2021 and 2022 (within GPDC, the predecessor model to ACO REACH) and increases for subsequent Performance Years, reaching a 3.5% discount for Performance Years 2025 and 2026. In contrast, the Professional program doesn’t offer a discount. By applying the discount to the benchmark used for reconciliation of realized spend, the discount increases the savings hurdle that must be realized to avoid shared losses and generate shared savings.

On a gross basis (prior to the Performance Year Discount), the Global track offers greater upside potential at any savings level. REACH ACOs in the Global track can capture 100% of the savings for amounts equal to or below 25% of the Performance Year Benchmark. In contrast, the Professional track’s risk corridors immediately impact the first dollar of savings.

Exhibit A — Risk Corridors

| Risk Corridors under ACO REACH: Percentage of Savings/Losses retained by ACO | ||||

|---|---|---|---|---|

| Risk Band | Risk Arrangement | |||

| Global Option (Full Risk) | Professional Option (Partial Risk) | |||

| % of Benchmark | Savings/Losses | % of Benchmark | Savings/Losses | |

| Corridor 1 | Less than 25% | 100% | Less than 5% | 50% |

| Corridor 2 | 25% to 35% | 50% | 5% to 10% | 35% |

| Corridor 3 | 35% to 50% | 25% | 10% to 15% | 15% |

| Corridor 4 | More than 50% | 10% | More than 15% | 5% |

However, the inclusion of the Performance Year Discount alters the balance of the programs and the relative “breakeven” point between Global and Professional shifts. Several factors contribute to this shift, including the relative first-dollar savings allocated to the REACH ACO (50% vs. 100%), the differentiated savings rates and thresholds in the risk corridor schemes, and the stepwise discount of the benchmark in the Global track.

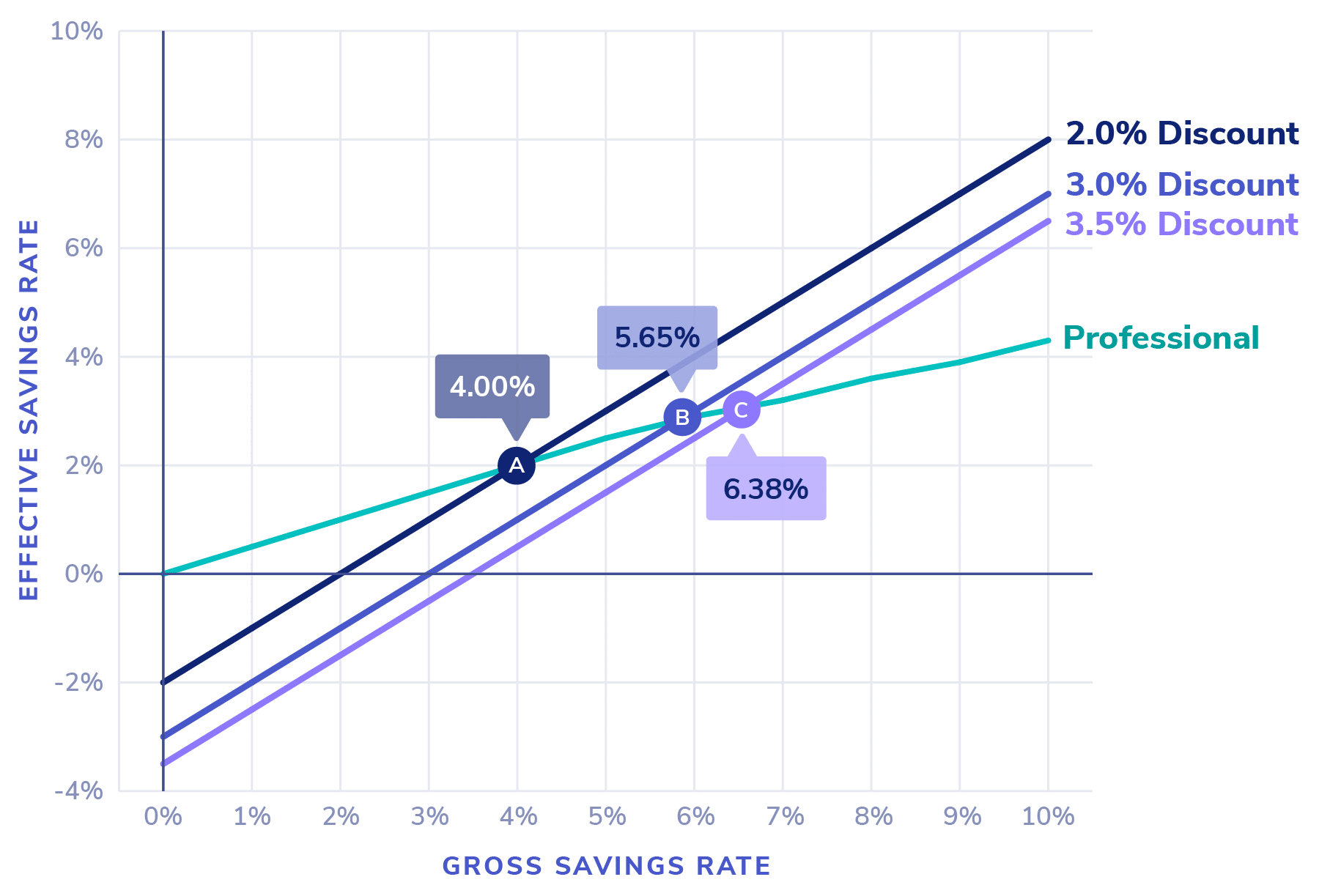

Exhibit B — “Breakeven” Curves

During Performance Years 2023 and 2024, the introduction of a 3% discount establishes a breakeven point at 5.65% in gross savings. This means that if an ACO anticipates savings exceeding 5.65% of the gross Performance Year benchmark (before applying the discount), opting for the Global track becomes advantageous. Conversely, if an ACO experiences savings below that threshold (or any amount of losses), the Professional track emerges as the favorable option. Looking ahead, as the discount increases to 3.5% in Performance Years 2025 and 2026, the breakeven level for Global experiences a slight increase, reaching 6.38%.

The interplay and effects of these mechanisms are crucial considerations for participants when deciding which risk track to choose. The Professional track offers better protection against losses and more favorable financial outcomes at lower savings levels, depending on the performance year. On the other hand, the Global track may be more appealing to those projecting higher savings levels and possessing a higher risk tolerance.

To sum up, the introduction of the Performance Year Discount adds a significant aspect to the ACO REACH landscape, demanding a comprehensive evaluation of the Global and Professional tracks. Participants must thoughtfully analyze these mechanisms and the corresponding breakeven points to make informed decisions that align with their own objectives and risk tolerance. Pearl is here to guide you through the intricacies of ACO REACH. Together, we can leverage the advantages offered by the Performance Year Discount, and embark on a transformative journey that brings about tangible enhancements in patient care and overall well-being.