Following his appointment as Administrator of the Centers for Medicare and Medicaid Services (CMS), Dr. Mehmet Oz has signaled that combating fraud, waste, and abuse (FW&A) in federal healthcare programs will be a major policy priority. This focus comes at a critical juncture: Medicare faces looming insolvency. Current and past administrations have signaled a desire to avert Medicare Trust Fund insolvency through, among other strategies, widespread adoption of value-based care (VBC) programs through CMS and the Center for Medicare and Medicaid Innovation (CMMI).

While a failure to confront widespread FW&A concerns could have a pronounced chilling effect on VBC adoption, meeting this moment with adequate focus and reform could accelerate necessary transitions to outcomes-based Medicare programs. In other words, these dual imperatives — strengthening program integrity while accelerating the transition to value-based payment models — can be mutually reinforcing.

This piece is co-authored by leaders at Pearl Health and Falcon Health — two organizations committed to building a more sustainable healthcare system through technology and innovation. Falcon Health, a company focused on transforming program integrity through advanced analytics and intelligent monitoring, conducted original analysis of Medicare claims data to uncover emerging patterns in fraud, waste, and abuse (FW&A) and surface critical gaps in current oversight systems. Here, we examine how current approaches to FW&A detection and resolution are structurally misaligned with the evolving healthcare landscape and value-based care goals. Drawing upon insights from Falcon Health’s analysis of comprehensive Medicare claims data, we outline a framework for modernizing program integrity efforts to both reduce inappropriate spending and accelerate value-based care adoption.

The Evolving FW&A Landscape: Current Oversight Limitations

Medicare Administrative Contractors (MACs) serve as the first line of defense against improper payments, processing over 1 billion Medicare fee-for-service claims annually. However, their capacity to identify emerging FW&A schemes has not kept pace with increasingly sophisticated patterns of abuse.

The recent controversy surrounding external urinary catheters illustrates these limitations. From 2019 to 2022, Medicare spending on these devices increased from a steady quarterly spend under $100 million prior to 2023 to over $800 million in Q4-23. This explosive growth stemmed largely from questionable billing practices by a small group of suppliers (seven entities were responsible for more than $2 billion in spending). Yet MAC detection systems failed to flag these anomalies in a timely fashion. Rather, they were identified by Accountable Care Organizations (ACOs) that were at risk for the fraudulent spend. Enforcement agencies failed to take action until improper payments had already reached hundreds of millions of dollars.

Similar patterns are emerging in wound care biologics and skin substitutes, where federal prosecutors recently charged an Arizona-based company for fraud summing more than $900 million. A recent Office of Inspector General (OIG) report highlighted “significant program vulnerabilities” in this area, with preliminary analysis suggesting widespread non-compliance with coverage requirements.

These examples highlight two critical weaknesses in current oversight mechanisms:

- Reactive rather than proactive detection: Current systems typically identify problematic billing patterns only after significant improper payments have occurred, often triggered by whistleblower actions rather than systematic analytics.

- Siloed data analysis: MACs generally analyze claims within their regional jurisdictions, potentially missing nationwide patterns or schemes that deliberately operate across regions to avoid detection thresholds.

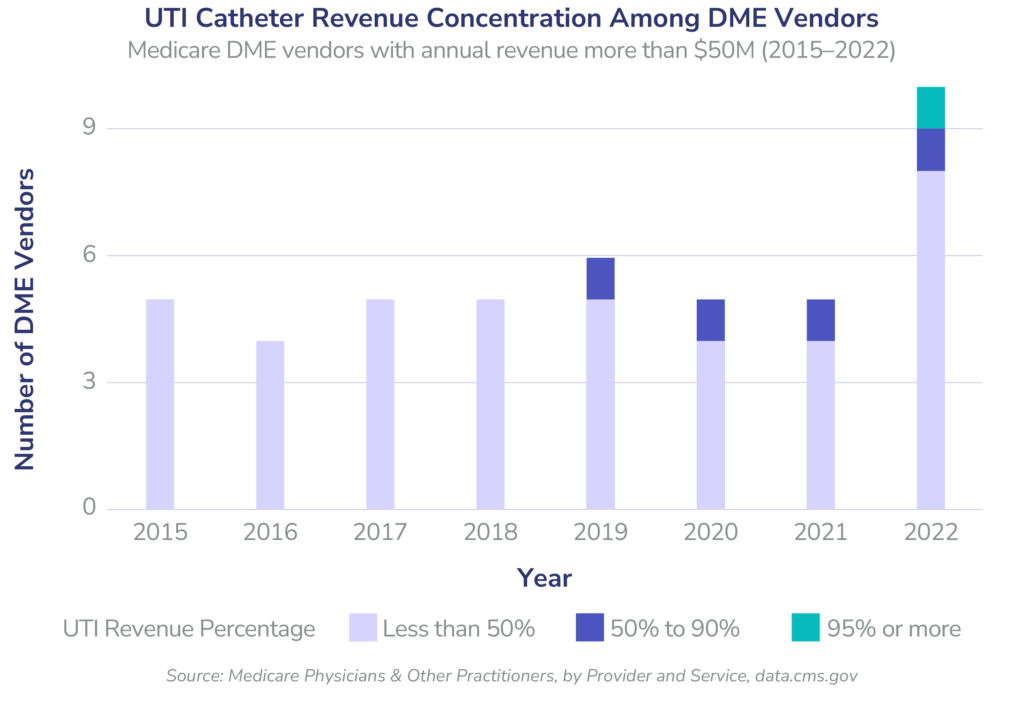

Falcon Health’s analysis of Medicare claims data indicates that earlier detection using advanced analytics could have flagged the urinary catheter billing anomalies up to 36 months earlier, potentially preventing hundreds of millions to over $1 billion in questionable payments. Our examination of DME suppliers with annual revenue exceeding $50 million revealed concerning concentration patterns emerging as early as 2019 (Figure 1). Prior to 2019, all high-revenue DME suppliers derived less than 50% of their revenue from urinary catheters. By 2019, vendors with moderate concentration (50-90% of revenue from catheters) began to appear in the market. Most alarmingly, in 2022 — a full year before the dramatic spending increase — the first vendor with extreme concentration (over 95% of revenue from catheters) emerged, coinciding with a doubling in the total number of high-revenue suppliers. These patterns represent clear warning signs that should have triggered enhanced scrutiny under a more sophisticated analytics framework. Instead, these anomalies went undetected by MAC oversight systems until ACOs, bearing financial risk for these claims, identified the improper payments after they had already reached hundreds of millions of dollars.

Prolonged Resolution Processes Undermine Value-Based Care Goals

When government agencies identify FW&A, resolution timeframes present an equally challenging barrier to program integrity. Department of Justice (DOJ) investigations and settlements frequently span years from initial detection to resolution. This extended timeline creates problematic ripple effects throughout the healthcare system, particularly for value-based care programs.

ACOs remain exposed to potentially fraudulent spend until such a time as government action is taken. Retroactive changes to remove fraudulent spending from ACO shared savings/losses calculations can take years —sufficiently long that ACOs may well face insolvency through artificially diminished shared savings (or even payments for losses) while awaiting the confirmation and removal of prima facie apparent fraudulent billings from settlement calculations.

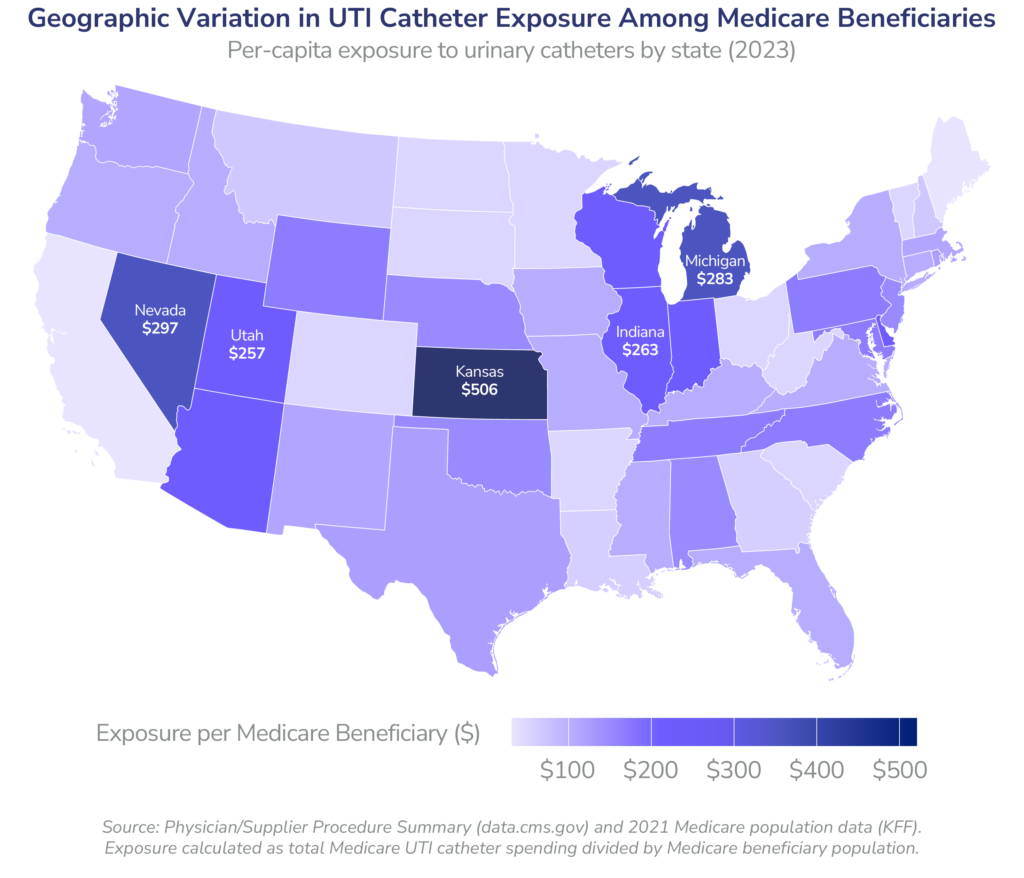

Falcon Health’s analysis of Medicare claims data demonstrates that this uncertainty creates significant financial exposure for ACOs in their shared savings/losses calculations. The geographic variation in UTI catheter spending — reaching as high as $506 per beneficiary in Kansas and exceeding $250 in several Midwestern states — directly translates to financial risk for ACOs operating in these regions. While CMS fortunately took action in this particular UTI catheter case, numerous other potentially fraudulent billing schemes remain undiscovered or unaddressed. ACOs must continue sharing in these costs until investigations conclude, a process that often takes years. This financial uncertainty undermines the ability of affected ACOs to invest in care improvement initiatives and threatens the stability of value-based payment models that depend on accurate assessment of true medical costs.

The Chilling Effect on Value-Based Care Adoption

Perhaps most concerning is how current FW&A approaches directly conflict with Medicare’s ambitious value-based care goals. CMMI has established a target of having all Medicare beneficiaries in accountable care relationships by 2030, requiring significant expansion of ACO participation. However, current FW&A approaches create several barriers to this expansion:

- Investment uncertainty: The threat of retroactive recoupments years after performance periods makes financial planning and return-on-investment calculations highly unpredictable for potential ACO participants.

- Disproportionate risk for primary care: Primary care providers, who form the backbone of successful ACOs, operate on thin margins and cannot absorb the financial risk of potential recoupments based on the actions of specialists or other providers that bill Medicare, over which ACOs have no utilization management tools.

- Administrative burden: Current compliance approaches require significant documentation and administrative resources that disproportionately burden smaller practices — the very groups Medicare needs to participate in VBC models to reach its 2030 goals.

Medicare ACO program data reveals this chilling effect: despite significant incentives for new participation in the redesigned MSSP, the 2023 cohort added only 69 new ACOs — far below the growth rate needed to achieve CMMI’s 2030 goal.

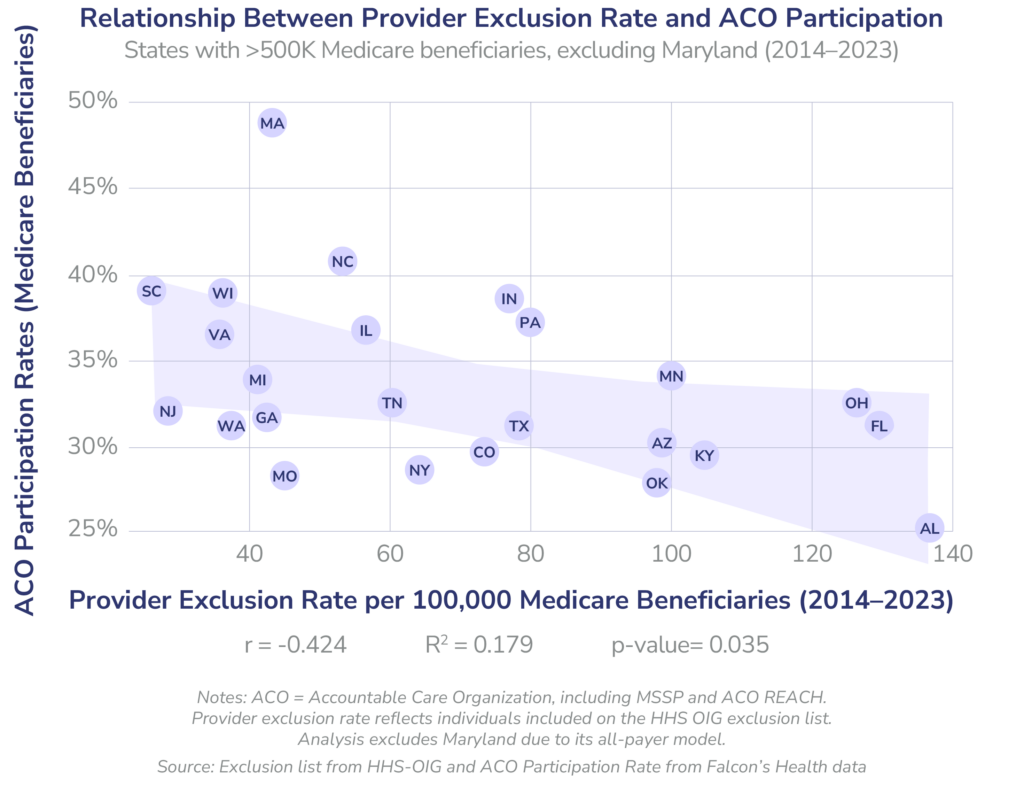

Analysis of Medicare data reveals a notable correlation between provider exclusion rates — a key indicator of fraud, waste, and abuse enforcement activity — and ACO participation across states. Our findings demonstrate a moderate negative correlation (r = -0.424, p < 0.05) between the rate of providers on the HHS OIG exclusion list and Medicare beneficiary participation in ACOs. While this relationship alone cannot establish causation, it raises important questions about potential unintended consequences of program integrity approaches. This pattern merits further investigation to understand whether providers in regions with historically higher enforcement activity may be more hesitant to enter value-based care arrangements due to perceived compliance risks; or if, on the other hand, more active value-based participation has a chilling effect on fraud.

.

A Path Forward: Modernizing FW&A Approaches

Addressing these challenges requires a fundamental reimagining of Medicare’s approach to program integrity. We propose three key reforms:

1. Implement Advanced Analytics for Proactive Detection

MACs must transition from retrospective review to proactive identification of anomalous billing patterns with greater sensitivity in order to prevent disbursement of government funds for likely fraudulent or wasteful spending. This approach requires:

- Deployment of machine learning algorithms capable of identifying unusual billing patterns across provider types, geographies, and time periods

- Real-time integration of claims data across MAC jurisdictions to enable national-level pattern detection

CMS could achieve these capabilities either through significant upgrades to MAC analytical infrastructure or through strategic partnerships with specialized analytics firms that can provide these capabilities, potentially more cost-effectively.

2. Streamline Resolution Processes

The current multi-year timeline for FW&A investigations creates untenable uncertainty for providers and ACOs. Reform options include:

- Establishing expedited review processes for cases below certain monetary thresholds

- Creating “safe harbor” provisions that protect ACOs from recoupment when they have implemented prescribed FW&A identification programs and make timely filing of suspected FW&A

- Establishing limits on lookback periods for ACO recoupments (but not beneficial adjustments) related to provider actions outside of the ACO

3. Align Program Integrity with Value-Based Care Goals

Effective FW&A prevention and value-based care share the same fundamental goal: ensuring appropriate utilization of healthcare services. Medicare can better align these tools to achieve improved outcomes by incorporating FW&A prevention metrics into ACO quality measures, creating positive incentives for compliance and built-in “whistle-blower rewards”.

Conclusion

As Secretary Kennedy and Administrator Oz develop their approach to evolving program integrity, they should embrace the opportunity to fundamentally transform how Medicare addresses FW&A. Rather than viewing program integrity and value-based care as separate initiatives, a modernized approach would recognize them as complementary strategies for ensuring the sustainability of the Medicare program.

By implementing advanced analytics for early detection, streamlining resolution processes, and aligning program integrity processes with value-based care reconciliation timelines, Medicare can simultaneously reduce inappropriate spending and accelerate the transition to higher-value care. With the Medicare Trust Fund facing insolvency by 2033, this alignment is not merely desirable — it is essential for preserving the program for future generations.