The August 1st enrollment deadline for participating in Medicare’s ACO REACH Model in 2025 is rapidly approaching. To help answer questions for those considering participation, on July 11th, Pearl hosted a free informational webinar on ACO REACH. This session with our Vice President of ACO Operations & Strategy, Michael Monsegur, and Chief Operating & Compliance Officer, Gabe Drapos, is now available to stream on demand.

Whether your practice has had experience with ACOs in the past or you are new to value-based care, we’re here to help you understand the ins and outs of ACO REACH so you can evaluate your options with as much information as possible.

5 Key Takeaways

What is ACO REACH?

The Centers for Medicare & Medicaid Services (CMS) redesigned their previous Direct Contracting model to create a new value-based care model: Accountable Care Organization Realizing Equity, Access, and Community Health (ACO REACH).

The ACO REACH Model was designed specifically to:

- Transform risk-sharing arrangements in Traditional Medicare (fee-for-service);

- Advance health equity to provide better care to all patients, and especially to underserved communities; and

- Reduce provider burden to meet healthcare needs effectively.

The model presents an opportunity for primary care providers and groups to transition to a more proactive care model for their Medicare patients, align incentives with keeping patients healthy, and increase revenue for effectively managing care.

How ACO REACH is different from previous value-based care models

In addition to their goal to invest more deeply in health equity, CMS created ACO REACH in large part to address stakeholder feedback from previous models and make value-based care more patient- and provider-centric. Key features of the ACO REACH Model include:- Stabilized Revenue: Enables transition from fee-for-service (FFS) to predictable per beneficiary per month (PBPM) payments;

- Less Administrative Work: Claims-based quality metrics; no chart submissions, EMR pulls, or MIPS;

- No Minimum Savings Rate: Groups earn the first dollar of shared savings; and

- Voluntary Alignment: Allows providers to grow their ACO panel throughout the performance year.

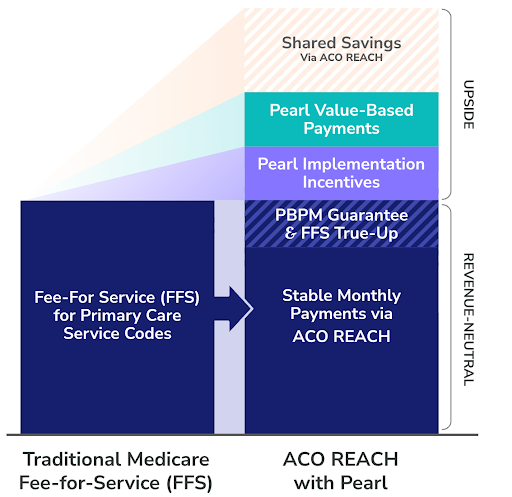

What are the key financial components of ACO REACH?

There are three key financial mechanisms that primary care providers need to know about partnering with Pearl under Medicare’s ACO REACH Model:

- Shifting from fee-for-service (FFS) payments to Primary Care Capitation;

- Entering into risk-based arrangements that offer the potential to increase revenue through shared savings; and

- Additional revenue upside through Pearl implementation incentives and value-based payments.

Primary Care Capitation (Stabilized Monthly Revenue)

Under the ACO REACH Model, Primary Care Capitation (PCC) gives primary care providers and organizations financial freedom, enabling autonomy to deliver care to Traditional Medicare patients as they see fit. PCC does this by transforming the compensation model from volume-based payments for the number of primary care services they provide to stable, monthly payments for revenue CMS estimates the provider would otherwise make from their Medicare patient panel.

Starting in 2025, PCPs must accept 100% capitation with 0% fee-for-service reimbursement for primary care services — a substantial shift from 2024, when they could transition as little as 20% of their primary care service revenue from FFS to PCC. This move to 100% PCC reflects CMS’ belief in the impact of providing stable monthly payments that enable providers to focus on the value, rather than the volume, of care delivered.

While Primary Care Capitation is intended to be revenue neutral, Pearl is here to provide additional peace of mind for providers and organizations making the transition. We offer qualifying partners in our network:

- A guaranteed per beneficiary per month (PBPM) payment that locks in a defined stable monthly payment rate up front, regardless of the PCC rate determined by Medicare; and

- Quarterly FFS true-up payments that make up the difference in the event the fixed monthly payments are lower than what FFS payments would have been.

Risk-Based Arrangements

At a high level, Medicare establishes a benchmark under the ACO REACH Model based on historical claims data, factoring in typical regional costs, the projected level of care needed for a given patient panel, and the trend of inflation in healthcare costs, among other factors. This benchmark represents how much Medicare believes it should cost to deliver primary care services for a typical patient in a given practice’s patient panel.

In value-based risk arrangements like ones supported under the ACO REACH Model, practices must deliver care at a lower cost than the benchmark to generate savings. In contrast, if they deliver care at a cost greater than the benchmark, this results in losses. These losses can be shared, both by Medicare and partners like Pearl.

Pearl helps providers enter into risk-based arrangements by taking on asymmetric risk on their behalf — in some cases, supporting no-downside risk arrangements, while going in as partners for those practices ready and willing to take on risk. We do this in exchange for portions of the shared savings that we believe providers will generate by leveraging our software and services to help them beat the benchmark.

Additional Upside Through Pearl: Improving Revenue vs. Fee-for-Service

On top of revenue-neutral Primary Care Capitation and potential upside through shared savings, Pearl offers providers two additional opportunities for guaranteed revenue above-and-beyond what they would earn in a FFS payment model:

- Pearl Value-Based Payments reward proactive, high-quality care based on timely signals and recommendations from the Pearl Platform. These payments are treated as an advance on shared savings, creating a direct and timely link between the actions that lead to success in ACO REACH and the financial reward for those actions.

- Pearl Implementation Incentives offer an up-front investment per aligned beneficiary to support your transition to a more proactive care model.

Ready to See the Financial Impact?

Share a few details with us and receive a personalized analysis of how Pearl can work for your practice or network.

What primary care services are covered in this model? As a PCP, how much of my revenue can I expect to be capitated?

As outlined in the section above, there are several payment mechanisms under ACO REACH, one of which is Primary Care Capitation (PCC). This is the payment mechanism through which most PCPs will be reimbursed. PCC applies only to Evaluation and Management (E&M) services provided to aligned beneficiaries and replaces all of a provider’s E&M fee-for-service revenue. Providers will continue to receive FFS payment for non-primary care services outside the scope of PCC payment.

For an in-depth look at Primary Care Capitation codes, read this complimentary educational two-pager from Pearl: Primary Care Capitation in ACO REACH — What’s Included?

What are the quality measures in ACO REACH?

With ACO REACH, CMS strove to reduce the administrative burden of participating in value-based care. The ACO REACH program has just four Quality Measures (QMs):

- All-Cause Unplanned Admission for Patients with Multiple Chronic Conditions (UAMCC) — claims based

- Timely Follow-Up After Acute Exacerbations of Chronic Conditions (TFU) — claims based

- Risk-Standardized All Condition Readmission (ACR) — claims based

- The Consumer Assessment of Healthcare Providers & Systems (CAHPS®) Survey

As noted above, three of the four QMs are reportable by claims, so chart chasing is no longer required — and Pearl will help keep you on track through the normal course of providing outcome-oriented care.

To learn more about how each of the QMs listed above is defined, read this complimentary educational two-pager from Pearl: ACO REACH Quality Measures

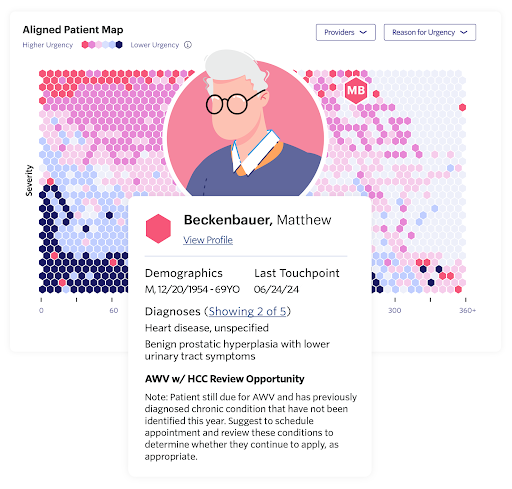

What is the role technology plays in helping providers succeed in ACO REACH?

Pearl Health is a physician enablement and technology company that helps primary care providers and organizations succeed in ACO REACH with the right finances, technology, and services.

We know that ACO REACH requires providing high-quality, proactive care to an entire patient panel, and we understand this represents a major shift from the fee-for-service model of focusing primarily on the patients in a doctor’s waiting room.

To support providers and their teams in delivering better, more proactive patient care, we designed our technology platform to help them:

- Identify at-risk patients and holistic care needs across preventive (e.g., due for an Annual Wellness Visit), acute (e.g., transition of care), and predictive (e.g, preventable ED visit) needs;

- Engage patients via a simple, prioritized workflow that recommends the next best action for each individual to improve outcomes and reduce downstream costs; and

- Align financial incentives with acting on timely, proactive care recommendations from the Pearl Platform to drive engagement and patient outcomes.