Background

Independent Primary Care Providers (PCPs) are hurting across the country. While this malaise is a symptom of several trends impacting in concert, we believe the most critical issues are diagnosable and addressable. PCPs are overburdened with administrative tasks delegated to them by a system that has demonstrated indifference to the impacts of these mandates on Primary Care. They are under-compensated, compared both to other verticals of the healthcare system (among the lowest ranked specialties by annual compensation) and to the value they bring to that system (the average PCP generally earns $266k, but influences ~$10M in downstream healthcare costs).1,2

Value-based care models across payor risk verticals are intended, at least in part, to address the latter issue. Providers participating in Accountable Care Organizations (ACOs), or similar value-based structures, can be rewarded for the effective, efficient management of their patient population. Historically, however, these programs have inundated providers with additional administrative tasks required to demonstrate the quality of the care they provide; and ACOs have not always ensured that the providers/practices responsible for delivering quality, efficient care are suitably rewarded. The CMS Innovation Center’s (CMMI) new ACO REACH Model helps address the problem of additional administrative burden by gravitating towards quality measures that can be collected passively (i.e. without requiring dedicated practice effort), and at Pearl Health we have rolled out shared savings constructs that more directly reward practices for their proportional impact in generating savings.

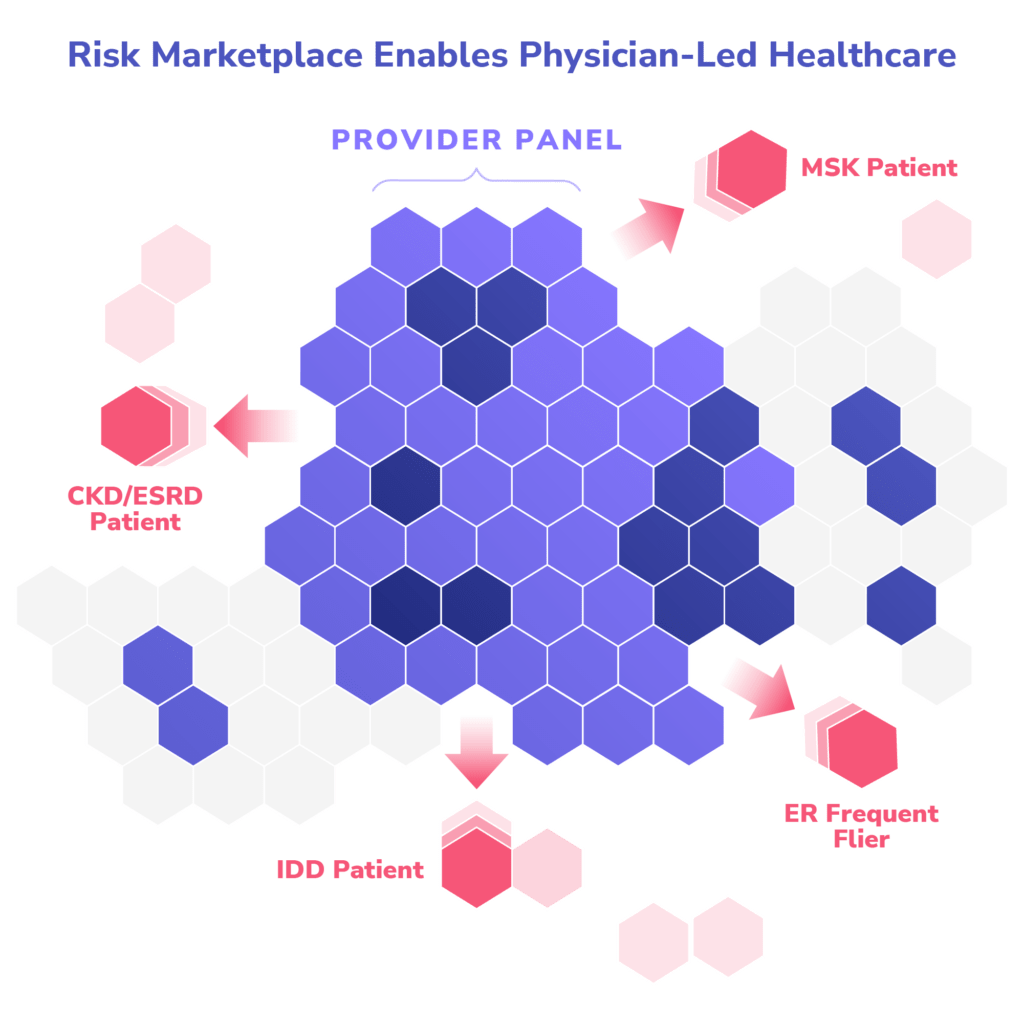

Specialty Risk Partners

Nonetheless, a core issue still remains: PCPs are the de facto aggregators of risk in these models, as patients are aligned to ACOs through their relationship to their PCP; yet primary care panels are generally random constructs motivated by non-clinical signals, such as friendly referrals (“This doctor is great–you should start seeing her!”), online directories, or plain old geographic convenience. PCPs will of course continue to require support in managing those subsets of their panels that necessitate more intensive or specialized care. Historically, that has meant referrals to local specialists. Getting those specialists contracted into value-based arrangements has required massive network development teams and invariably run into the increasingly oligopolistic market dynamics implied by integrated health systems, leading to the slower and stepwise expansion of value-based initiatives and an imbalance in negotiation leverage between independent PCPs and aggregated hospital/provider entities.

At the same time, there has been a proliferation of mission-driven companies founded to manage distinct cohorts of patients based on the clinical disease burdens they exhibit, bringing to bear novel care models and eschewing traditional healthcare network constructs. Pearl sees this new landscape of (what we call) Specialty Risk Partners (SRPs) as an opportunity to obviate the problems presented by most local market dynamics and move towards more fulsomely aligned virtual care teams supported by targeted local assets. We can identify SRPs that have demonstrated high-quality, efficient outcomes via appropriate care models for the relevant populations, collaborate on identification frameworks for delineating at-risk populations, and align them to supporting our PCP partners through financial incentives for generating savings.

How it Works

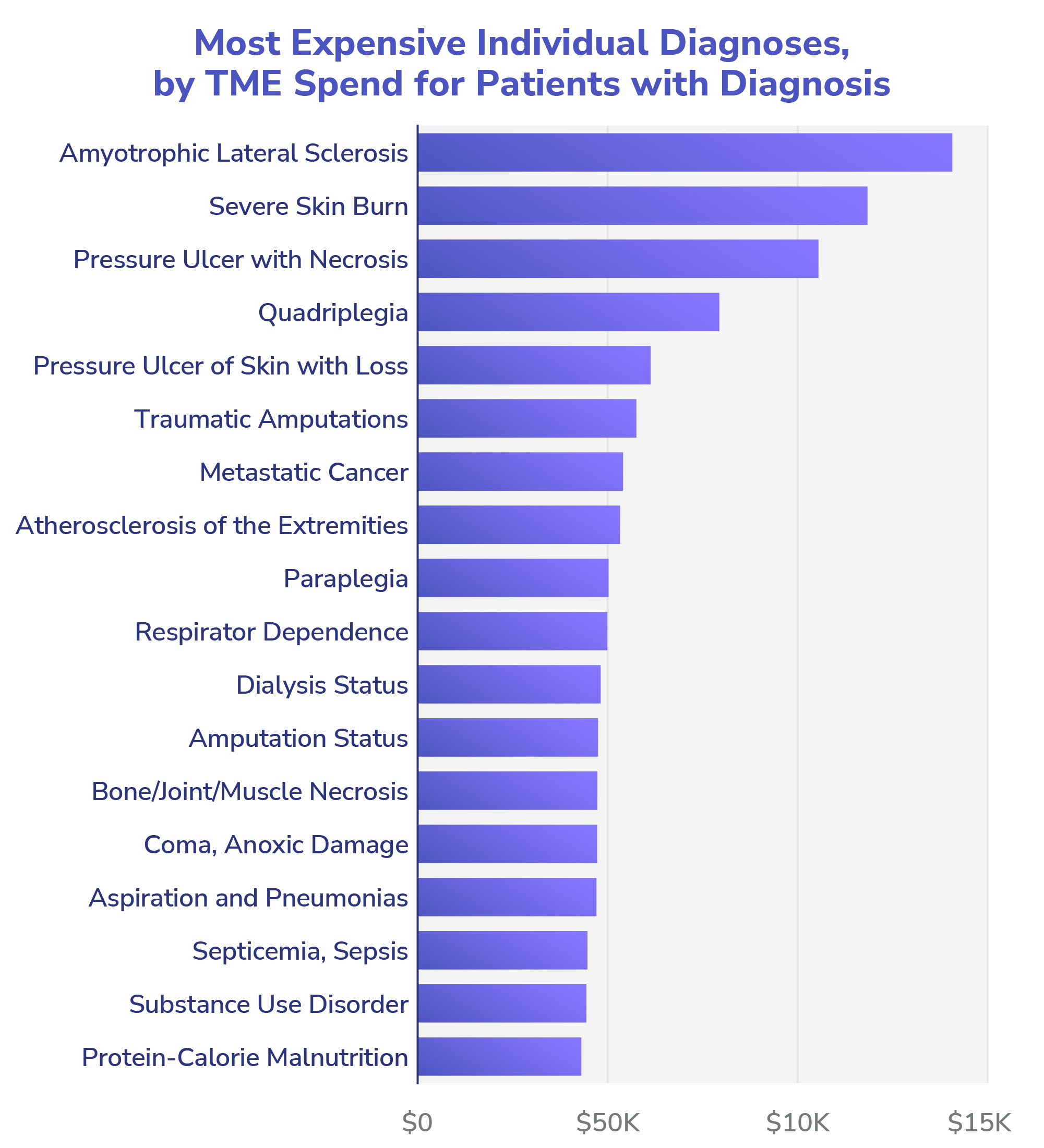

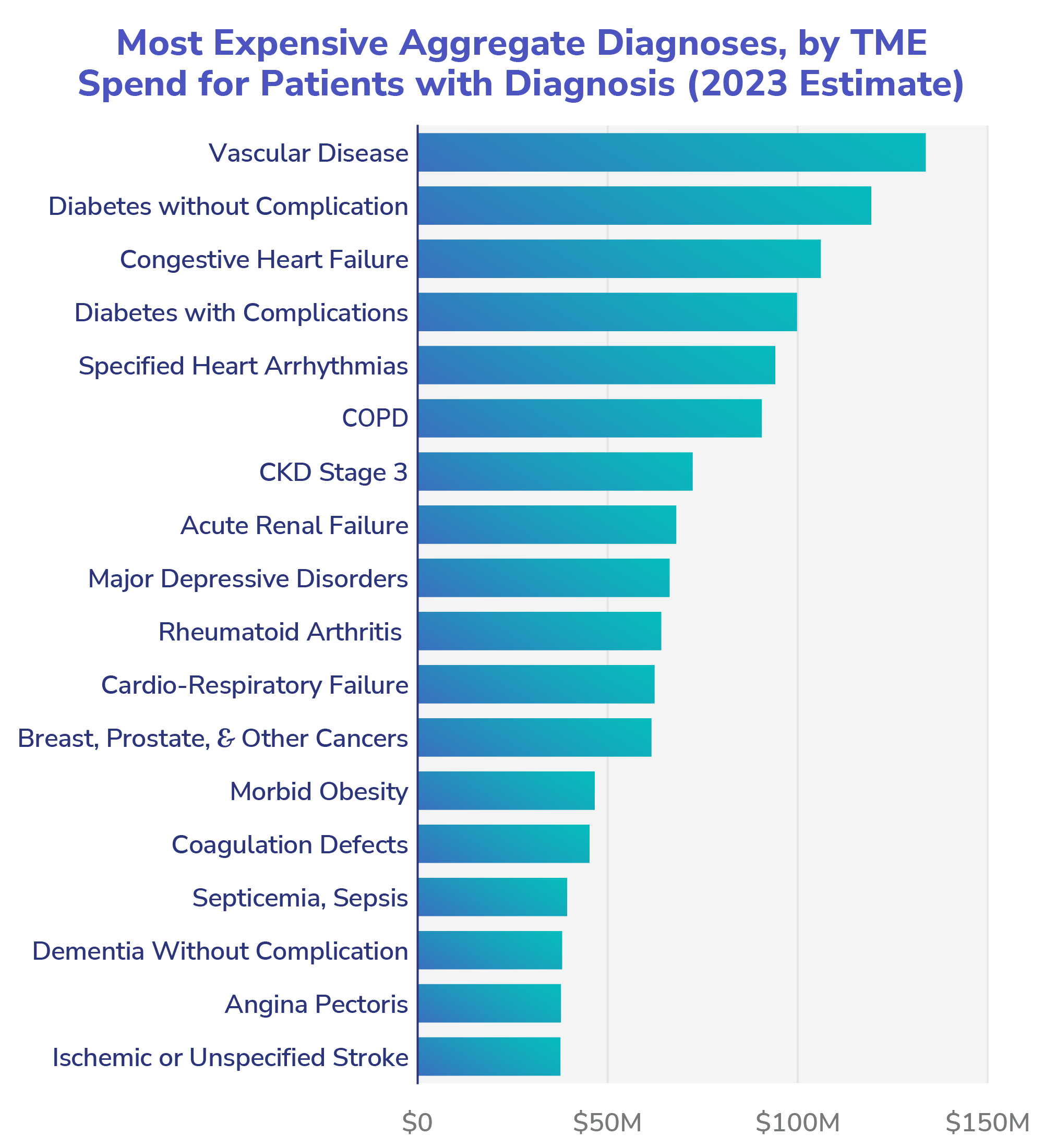

In order to structure effective co-management opportunities, we must first identify the population to be managed. If we begin with the universe of all Medicare beneficiaries aligned to our PCP partners through REACH’s historic claims alignment methodology, there are two salient criteria we must be mindful of: beneficiaries’ locations and their clinical signals. The former is straightforward: where these patients live. The latter depends on the best tools available to identify the relevant population implied by the SRP’s model.

Examples:

- An SRP focused on CKD/ESRD can leverage recorded diagnoses captured through HCCs (CKD stages 3–5 and ESRD codes).

- An SRP engaging patients with cardiovascular issues may find the HCC cohorting to be too high-level, and ICD-10 groupings of the appropriate sub-categories is necessary.

- An SRP focused on ER high-utilizers must agree upon the minimum threshold of historic ER utilization and use claims history to identify those patients who exhibit that pattern.

- An SRP targeting medication management in the context of polypharmacy will necessitate an aggregation of patients actively taking a sufficient number of prescription medications concurrently.

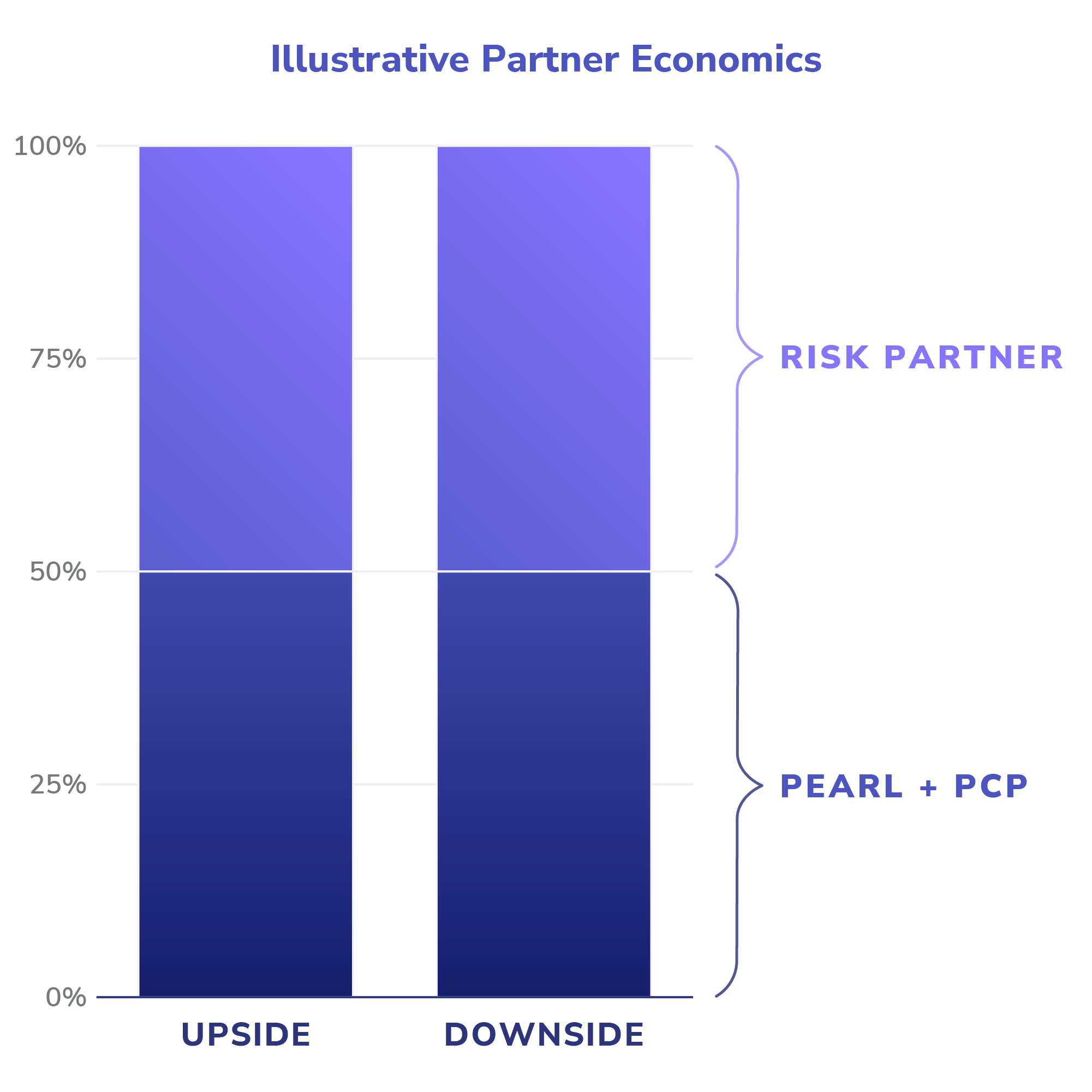

Once we have identified the relevant populations, we must agree upon financial incentives sufficient to engender alignment between Pearl, the PCP and the SRP. As a general principle, we believe that FFS Medicare revenue (whether truly FFS or capitation via trended historic spend) is a sufficient cash flow mechanism on an intra-year basis and, much like the ACO REACH model in which Pearl operates, we do not provide additional financing month-to-month.

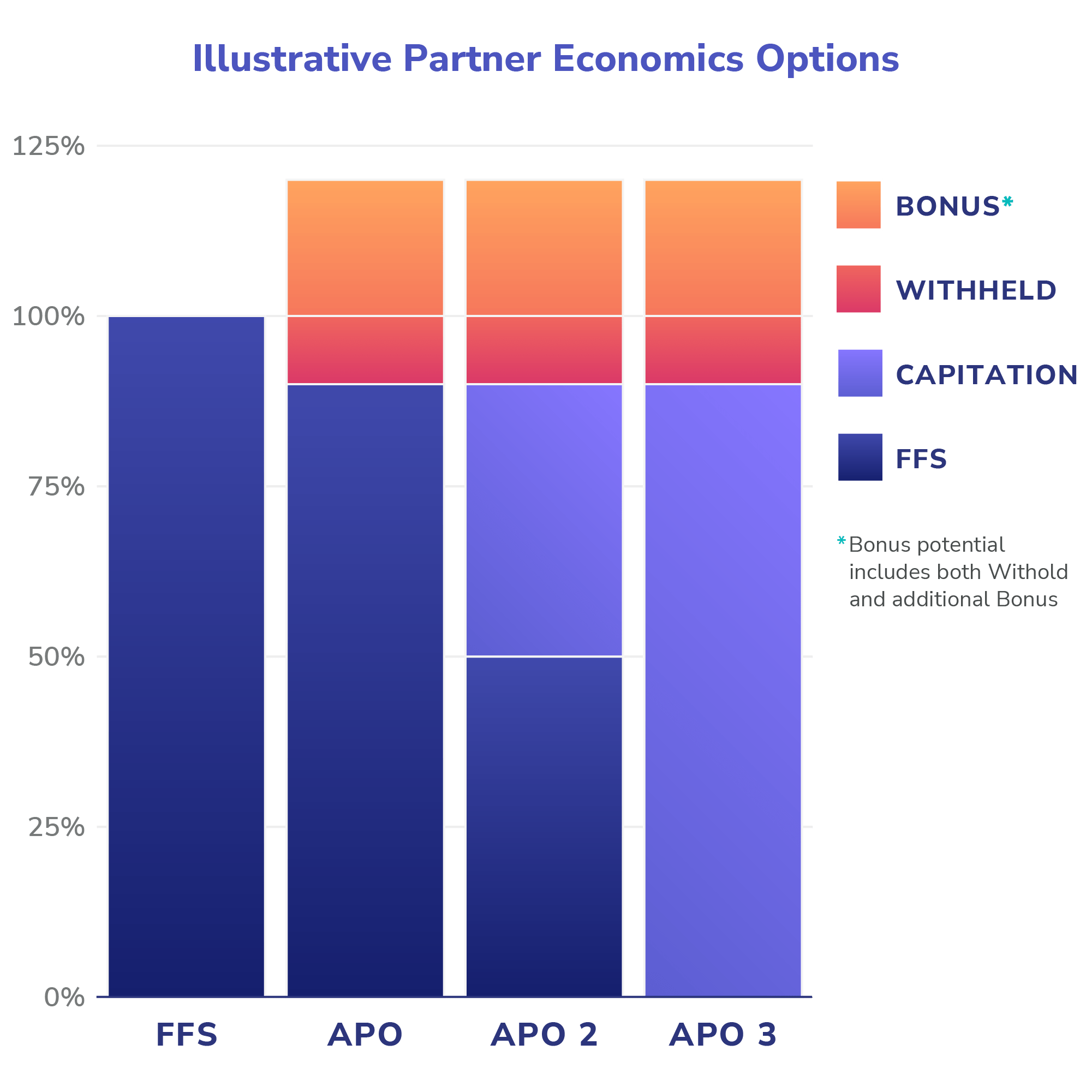

Instead, we make two options available to potential partners:

- SRPs can take symmetric upside/downside total medical expenditure (TME) risk on the relevant population, or

- SRPs can reduce their FFS Medicare revenue (receiving the remainder in either FFS or capitation form, or a mix of the two), with a potential to earn back both the withhold (the reduced amount) and various multipliers based on their ability to hit certain tiers of agreed upon quality measures that would imply achieved efficiencies in managing the population.

The first variant is most suitable to those SRPs that are managing conditions highly likely to be the primary drivers of outsized spend of the population for which they are responsible (e.g. the ESRD example above).

The second variant is more appropriate for those SRPs that can achieve clinical efficiencies, but in areas that are either (a) unlikely to represent the preponderance of expected medical costs for a population (e.g. ophthalmology), or (b) too reactive to acute precipitants to allow for a prospectively defined at-risk population (e.g. orthopedic surgery, reducing readmissions following hip fractures).

Once the population has been identified and the economics agreed upon, rolling out these targeted, wrap-around services to our PCP partners and the appropriate patients requires thoughtful messaging and tight operations. It is easy to abstract away to marketplace principles from other industries, but when we are dealing with patient care and peoples’ lives, it is critical to remember that the efficient reallocation of risk to those best suited to bear it is only the first step in a journey towards providing more efficient, more coordinated and higher quality care.

Source: Internal Pearl modeling of expected 2023 population.

A Critical Opportunity

The fault lines of the US healthcare system are reaching a critical breaking point: absent political intervention, the Medicare Trust Fund is on the verge of bankruptcy; costs throughout the system are skyrocketing and generally passed onto employers and patients, who are increasingly avoiding necessary care due to cost. As a poorly managed population continues to age, we will rapidly approach a crisis point. The moment requires more fundamental shifts in our approach than the historic incumbents have proven able or willing to enact. The first step has been providing PCPs with the financial structures and tooling to manage patients in a total-cost-of-care context. We applaud CMMI for its ongoing efforts to move the system towards capitation and full risk and away from volume-based incentives (and we hope other payors will follow with urgency). Pearl provides PCPs with technology to help them efficiently manage these patients in the context of primary care. The next step must be focused on aligning a flexible, virtually enabled network of specialty experts to support primary care. That is what we are currently undertaking.

Farzad Mostashari, Darshak Sanghavi, Mark McClellan, “Health Reform and Physician-Led Accountable Care: The Paradox of Primary Care Physician Leadership,” JAMA, May 2014.

- Medical Group Management Association (MGMA), “New MGMA research finds physician compensation on the rise,” Cision PR Newswire, May 2019.