Medicare may be one of the best healthcare markets for value based care models. The below arguments lay out why further investments in value based care models for Medicare may ultimately prove to be very successful. As we have written before, Medicare needs a substantive overhaul to maintain it’s actuarial sustainability, and improving alignment with providers may be one of the least disruptive ways to do so.

1. Longer Duration of Membership

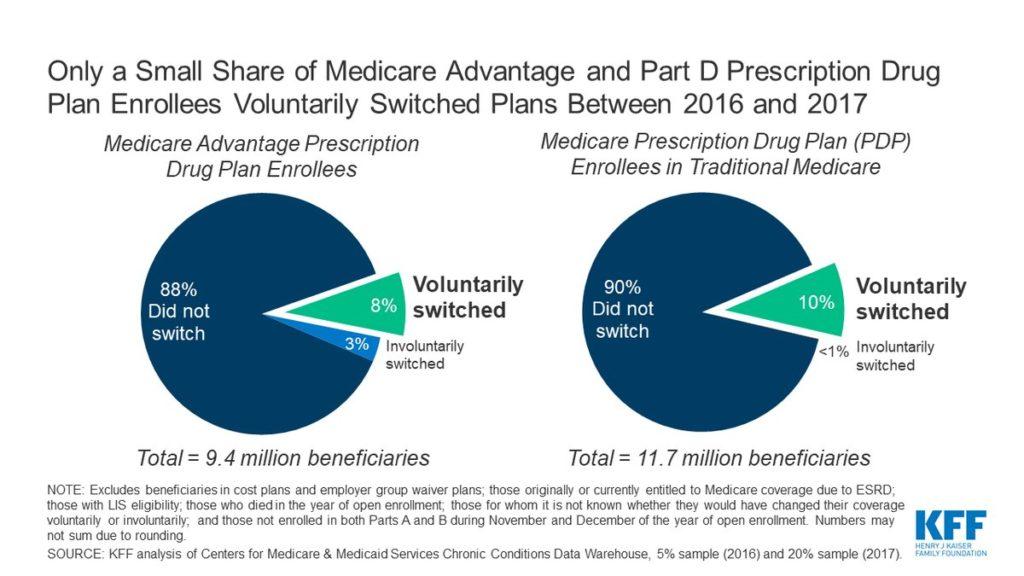

Whether in traditional fee-for-service or Medicare Advantage plans, the qualifying age and limited income requirements for enrollment makes the Medicare population much more stable, compared to commercial or Medicaid populations. While private insurance often sees people switching plans every 2-4 years, and Medicaid’s income requirements result in annual testing of eligibility for participation, Medicare populations tend to stay aligned with Medicare.1

This stickiness incentivizes those entities responsible for managing Medicare populations to make greater investment in the wellness and health of their Medicare beneficiaries, a key prerequisite to establishing powerful incentives in value-based care models.

2. High Expenditures

Medicare enrollees on average cost more than most other populations in the United States. According to the National Healthcare Expenditure Data: “Per person personal health care spending for the 65 and older population was $19,098 in 2014, over 5 times higher than spending per child ($3,749) and almost 3 times the spending per working-age person ($7,153).” 2 This population is also expected to see high growth rates in expenditures, reaching up to 5.1% over the next decade.3

While these high per-patient costs, in conjunction with an aging US population, will continue to impact Medicare’s sustainability, they also offer a substantial opportunity for providers to reduce wasteful spending and unnecessary utilization. Due to their central role in providing and coordinating care, Primary Care Providers (PCPs) are especially well-suited to address these high expenditures by getting the right care at the right time for seniors.

3. Easier Patient Alignment

One of the greater challenges of value based models is clarifying who is responsible for which patients. This becomes a very important problem, akin to the tragedy of the commons in economics, where it’s hard to hold providers accountable for outcomes when they don’t agree with who their patients are. This lack of clear ownership creates a disincentive to invest in uncompensated care. As the Society of Actuaries recently noted in a new research paper, “Attribution methodology is at the core of constructing actuarially sound, provider-accepted and operational Alternative Payment Models (APMs), and attribution is the most critical component of value-based contract design.”4

Medicare is perhaps one of the easiest populations to attribute, as patients have more reliable and longer-lasting relationships with their providers, especially PCPs.

4. Role of Primary Care

Medicare members visit physicians the most frequently, getting in-person prescription refills and seeking out guidance from ‘their physician’ for navigating the rest of the healthcare system more reliably than younger cohorts. Arrangements that align those doctors with the medical expenses they generate are most likely to succeed, as this financial alignment provides economic incentives to foster the type of relationships physicians already want with their patients: namely, ones built on trust, understanding, and longevity.

5. Policy and Regulatory Shifts

Direct Contracting is a huge policy shift in the direction of value-based care. The Center for Medicare and Medicaid Innovation (CMMI) has released a new model, effective April 1, 2021, that enables Primary Care Providers (and others) to receive attribution for their claims-aligned patients and, as a result, receive a monthly capitation payment and financial exposure to a total cost-of-care benchmark. This meaningful shift presents an opportunity for Primary Care Providers across the country to assess their potential economics in Direct Contracting and, more importantly, manage their patients more holistically and with less administrative burden. The policy and economic winds are likely shifting toward more economic empowerment of physicians and giving them more access to healthcare risk.

- https://www.kff.org/medicare/issue-brief/no-itch-to-switch-few-medicare-beneficiaries-switch-plans-during-the-open-enrollment-period/

- https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet

- https://www.kff.org/medicare/issue-brief/the-facts-on-medicare-spending-and-financing/

- https://revcycleintelligence.com/news/patient-attribution-key-component-to-apms-value-based-contracts