Dr. Ruiz is part of a REACH ACO

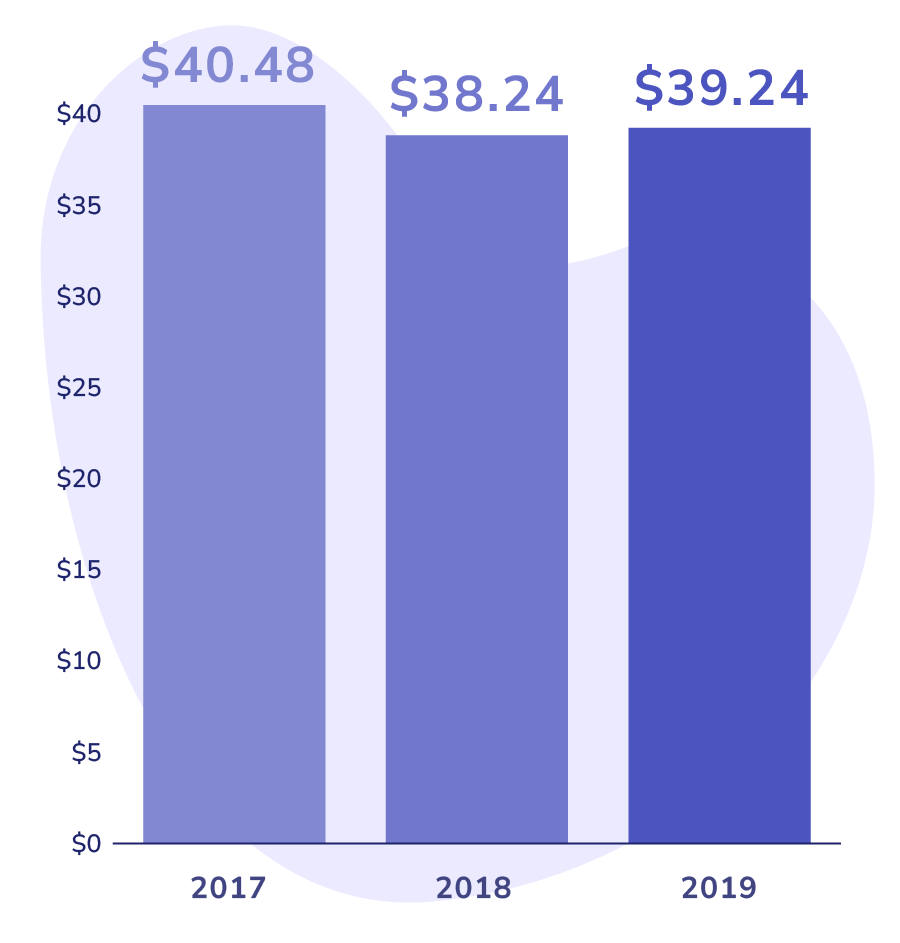

When she joined the ACO, they analyzed the historical spending patterns for her Medicare patients. In 2019, the average spending for primary care office visits per beneficiary per month (PBPM) was $39.24.

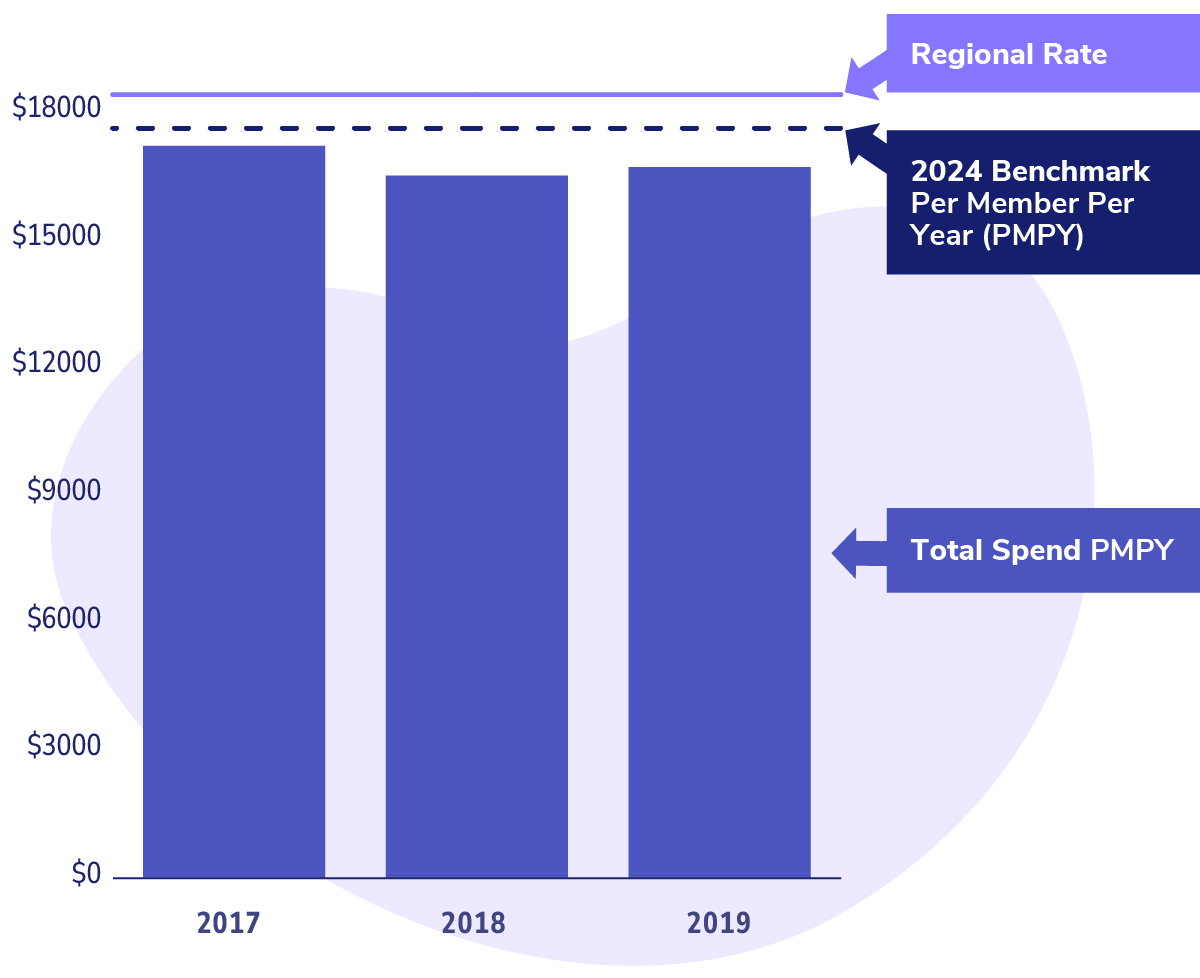

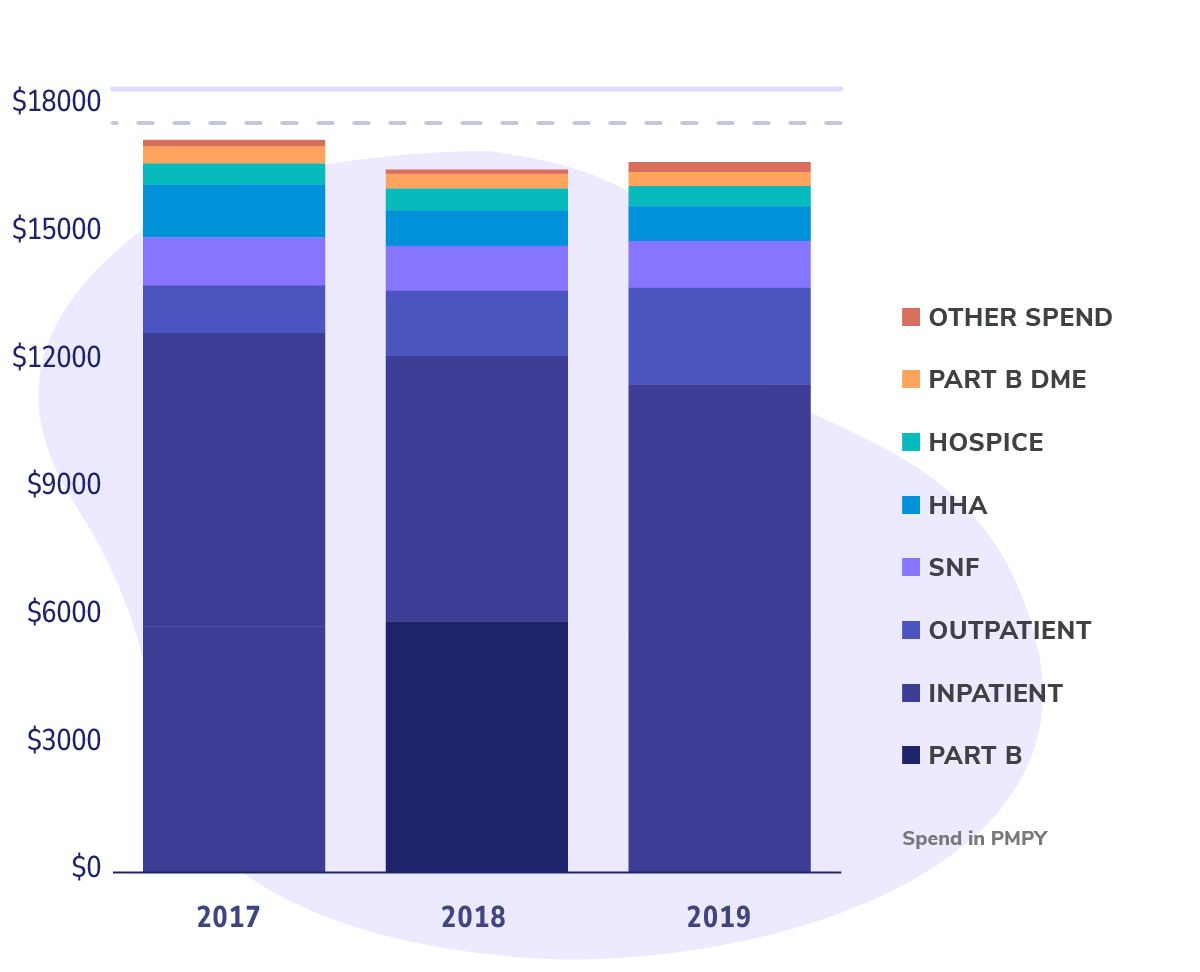

This PBPM amount forms the basis for determining the benchmark spend for the performance year and, ultimately, the capitation amount. Put simply, it’s about how much Dr. Ruiz will be paid by the ACO for each Medicare patient in her care.

$39.24

Per Beneficiary Per Month