(Healthcare) Risk Is Opportunity

The slogan for the Society of Actuaries is “Risk is Opportunity.” As providers consider managing healthcare risk through value-based models, they will convert risk into opportunities for themselves —opportunities to increase and stabilize their revenue, be more financially aligned to their patients’ health outcomes and the good work they got into medicine for, and the more elusive advantages of being on the vanguard of important change.

To be successful, they will need tools and information systems designed to manage that risk in real time; but what will also become obvious is that the more liquid — or cost-free — we can make getting access to healthcare risk, the better off we all will be.

A Brief History of Healthcare Risk

In our early modern history, patients predominantly bore their own healthcare risk. Prior to the creation of religious institutions that bore some of the healthcare risk of their flock, patients were fully exposed to the financial implications of managing their own health conditions.

In the 1900s, the emergence of capitation models structured by physicians to support corporations started to formalize the risk of healthcare and quantify it. Large companies offered it as a productivity and safety benefit for their laborers, and physicians priced it. The emergence of the health insurance industry was mostly a tax-advantaged way to provide compensation in the form of healthcare to workers and, with scale, do that fairly affordably.

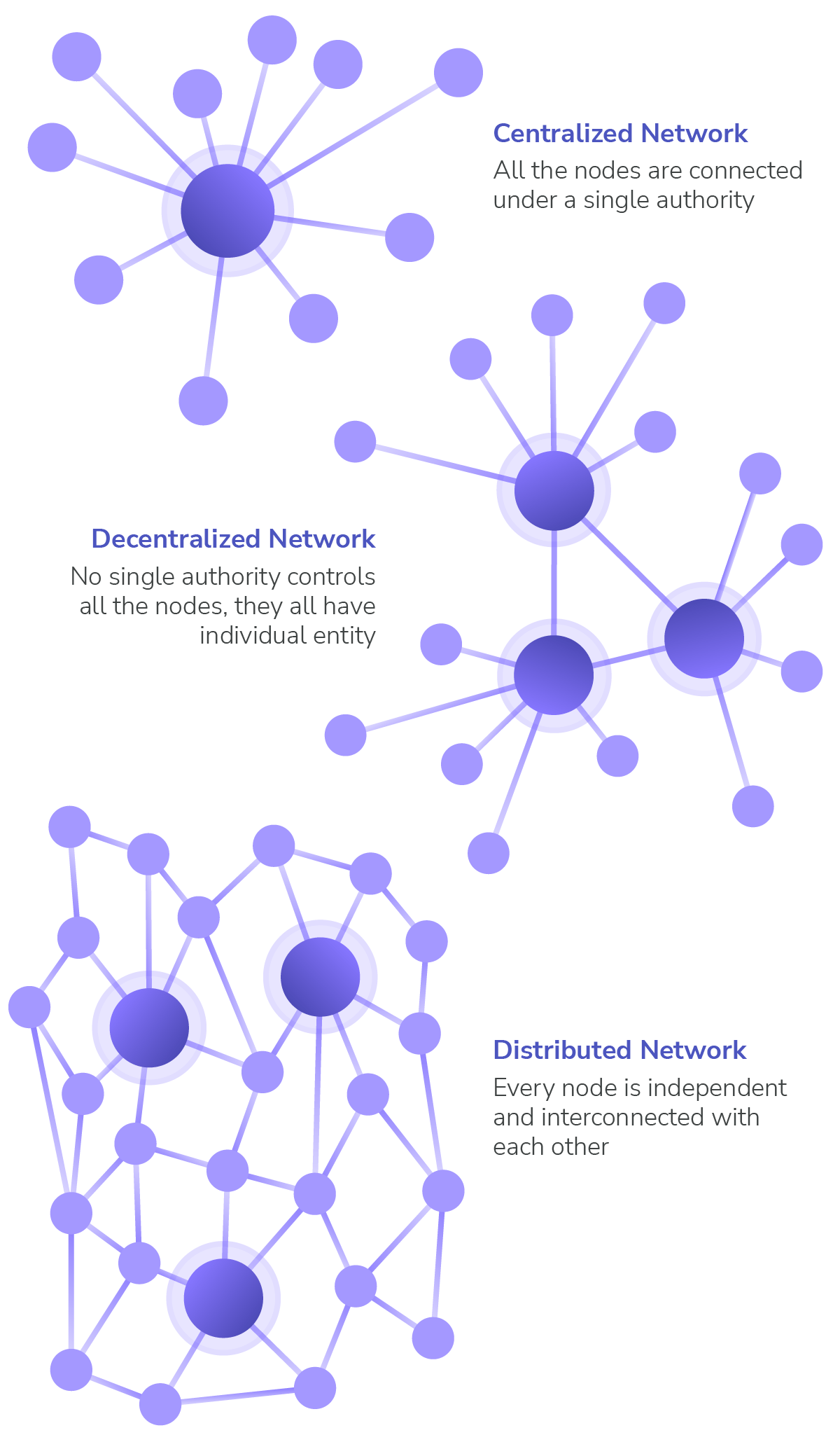

Fast forward to today, we see a complex system with most of the risk borne by large insurance companies — or the taxpayer, in the case of government health programs. This system is no longer cost efficient, but it is massive due mostly to the simple fact that managing risk historically has been done better at scale vs. a decentralized or distributed paradigm.

Expanding Access, Equity & Affordability in Healthcare Calls for Distributed Healthcare Risk

Centralized systems are inefficient: they’re slower and require greater reliance on monolithic actors than distributed systems. As we continuously look to expand the access, equity, and affordability of the healthcare system, we will necessarily need to look to more efficient delivery systems.

Image adapted from 101 Blockchains, “Centralized vs Decentralized vs Distributed Network: An Overview,” July 2018.

Source: Nephron Research, “Physician Enablement Update: The Second Inning,” Figure 2: Physician Enablement Company Landscape, July 2022.

This shift will see movement of risk from the centralized “big box retailer” of yesteryear to more distributed networks optimized to manage more localized, specific risk (think a single physician responsible for the outcomes of their own patient panel).

A catalyzing force toward this future is a new government model, the Accountable Care Organization Realizing Equity, Access, and Community Health (ACO REACH) Model, formerly known as Global and Professional Direct Contracting (GPDC) or simply Direct Contracting.

Not unlike government facilitation of other socially important markets like mortgages and credit, the ACO REACH Model brings resources, infrastructure and ultimately efficiency to managing healthcare risk and does that on the chassis of standardization and trust. As this standardization becomes more reliable and these types of structures proliferate, a large, liquid market emerges that supports investment in this critical policy area.

Supporting a Distributed Healthcare Delivery System through Primary Care

At Pearl Health, we see some tremendous opportunities in this transition to value-based care.

We’re eager to help support a more distributed, mesh-networked healthcare delivery system through our platform — a system that is powered by primary care and allows for greater independence of providers. We see too many of our resources focused on beating the billing, authorization, and denials business of our current system and not enough on root cause analysis and patient need. This shift in focus will result in better quality and higher satisfaction on behalf of patients.

As more providers can participate in the first dollar in healthcare, we forecast that a democratization of access to healthcare risk will ensue. This will not only lead to more financial opportunity for primary care, but will also enable more clinical innovation as models that focus on special needs and situations emerge and can serve patients directly.

With these changes, a new world aligned around value versus expenditures will emerge.

More Primary Care Providers Bearing Risk in Healthcare = Positive Network Effects = More Overall Success in New Paradigm

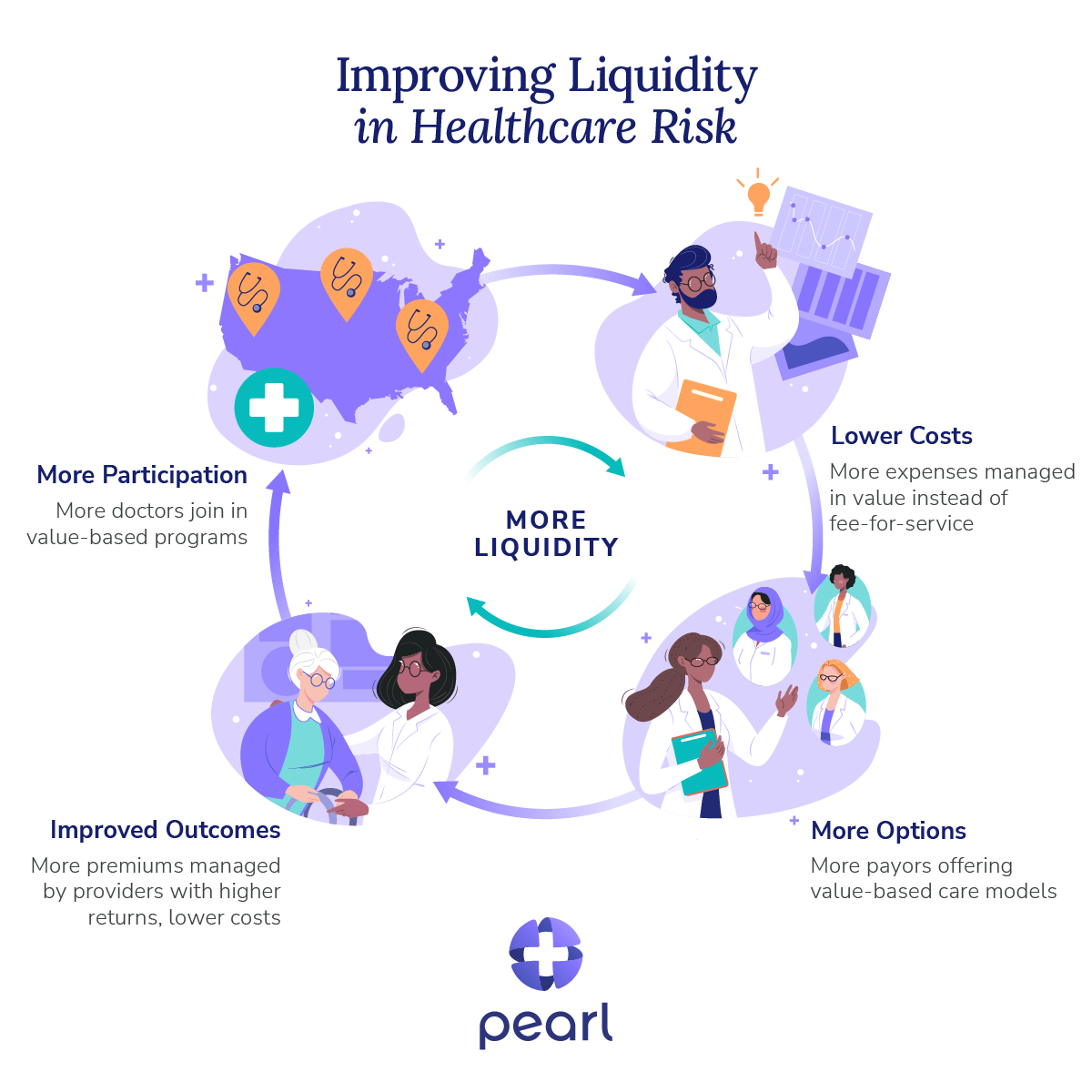

As we add providers who can effectively bear risk in healthcare, a tremendous network potential will accumulate that ultimately enables more providers, payers, and consumers to adopt and succeed in this new paradigm. This will lead to greater comfort with providers bearing risk, a community of like-minded physicians who can cooperate in these models, focused on patient outcomes and the total cost of care.

We’ll also see primary care providers become more central in the value chain, helping manage complex cases and armed with the information and the authority to guide their patients throughout the system. Over time, this will mitigate unnecessary utilization, whether ER admissions, avoidable surgeries or preventable in-patient care.

At Pearl, we’re focused on — and somewhat obsessed with — getting these primary elements working together at increasing speeds and expanding scale. It’s a simple flywheel that starts with providers (or doctors) as our core element. We assist them in participating in risk-based models by providing them data, technology, and support.

As we gain additional providers to Pearl’s model, we expand our network of enabled providers who can cooperate in a value-based network. This enables us to invite more payers to our model who can then offer more risk based models for our physicians. We start with Medicare but, as our network expands and our doctors perform, we can enter different lines of business.

This all combines to create a simple outcome: reducing the cost of accessing healthcare risk and improving liquidity of the system. It breathes oxygen into a financially broken system and implies a structure that pushes toward efficiency and savings instead of volume and expenditures.