As we expand on our Introduction to Capitation post, we pivot away from ACO REACH (the CMMI model replacing Direct Contracting) payment mechanism and shift to the economics an ACO must understand in order to provide quality care and enjoy sustained, long-term success. In this article, we discuss the two key levers that influence shared savings.

Benchmark

For those already living and breathing Medicare ACOs, the term ‘benchmark’ should be very familiar. For those who are new to value-based care, the benchmark is the Medicare-established budget unique to each ACO based on the disease burden, regional cost of care, historic care utilization, and proportion of underserved beneficiaries in a given population. ACOs must manage their attributed patients within this budget for the duration of the performance year, January through December. At the end of the year, if the total cost of care for beneficiaries aligned to an ACO is below the ACO’s budget, the ACO and its providers will share in the savings generated (i.e., shared savings). Conversely, if the total care for aligned beneficiaries costs more than the set budget, the ACO must pay back the difference to CMS (i.e., shared losses).

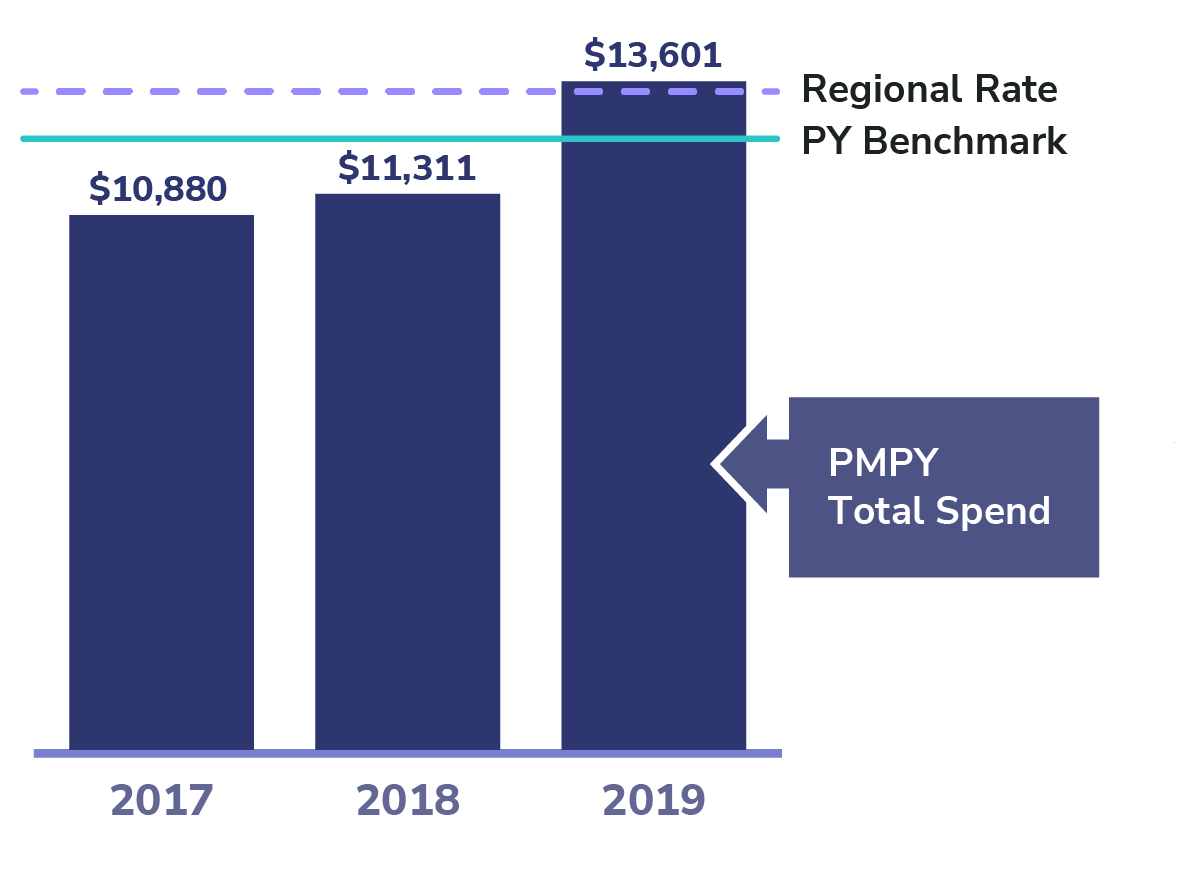

In 2023 ACO REACH, the performance year benchmark is established using a historical three-year baseline period: 2017, 2018, and 2019. CMS identifies which patients would have been aligned to the ACO during those baseline years and uses their historical costs (i.e., Total Medical Expenditures — TME), risk scores, and the regional TME rates to create the historical baseline benchmark. From there, CMS must make prospective adjustments to create the new performance year benchmark (PY benchmark). For PY 2023, Medicare adjusts for changes in disease burden (i.e., risk score) and costs (i.e., inflation) to trend the baseline benchmark forward to establish a PY benchmark in 2023 dollars.

Total Medical Expenditures (TME)

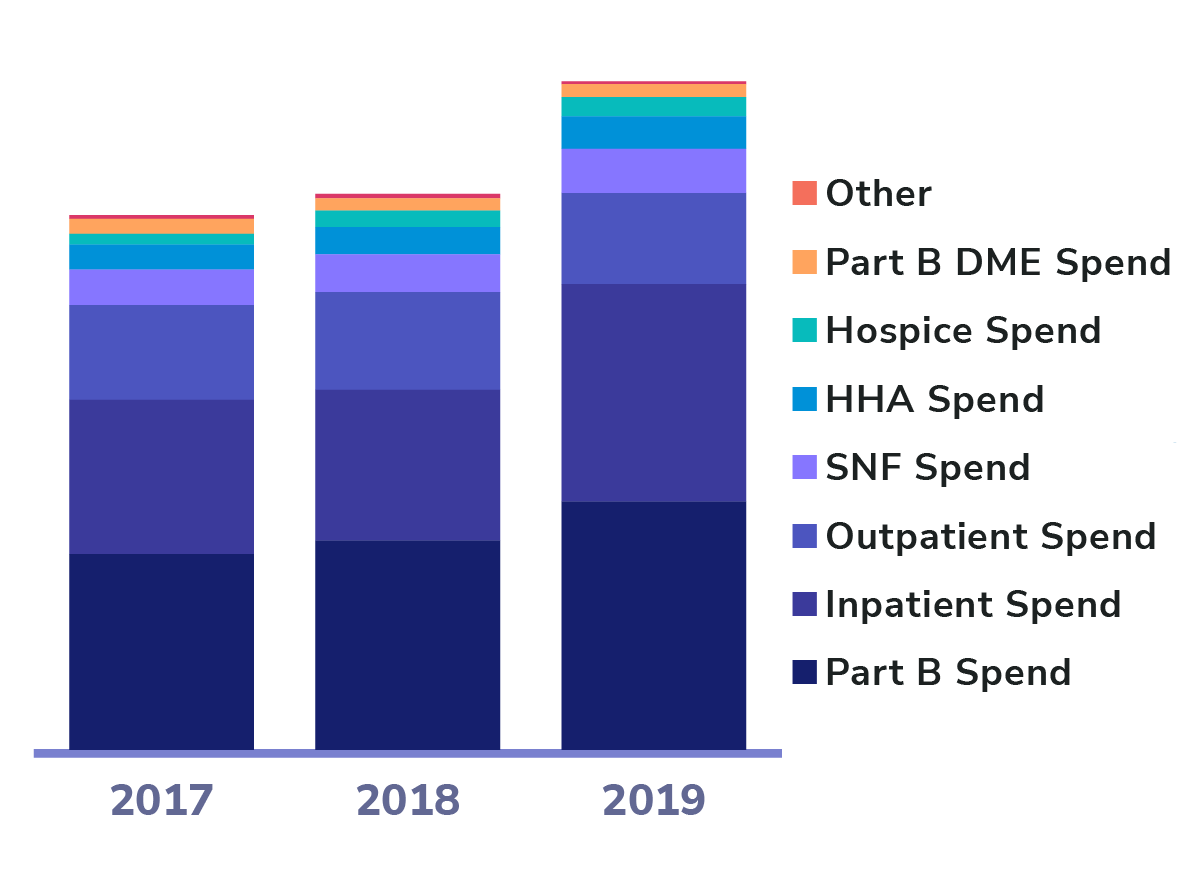

As mentioned above, the TME is the cost of care for all aligned patients that ACOs are accountable for managing. In ACO REACH, only Medicare beneficiaries (i.e., patients) with both Part A and Part B coverage are eligible for the program and only those expenditures are included in the benchmark. What’s unique to Medicare, challenging for ACOs, and different from other payers is that ACO beneficiaries can seek care from any Medicare provider, despite being aligned to a specific ACO, so ACOs are still at risk for their aligned patients’ Part A and Part B spend even if it’s with a non-ACO provider. ACOs generally use incentives to encourage beneficiaries to seek care from ACO providers instead of the more painful requirements exhibited by health insurance and Medicare Advantage plans (e.g., defined networks, referral requirements, and utilization management).

Key Levers to Generate Savings

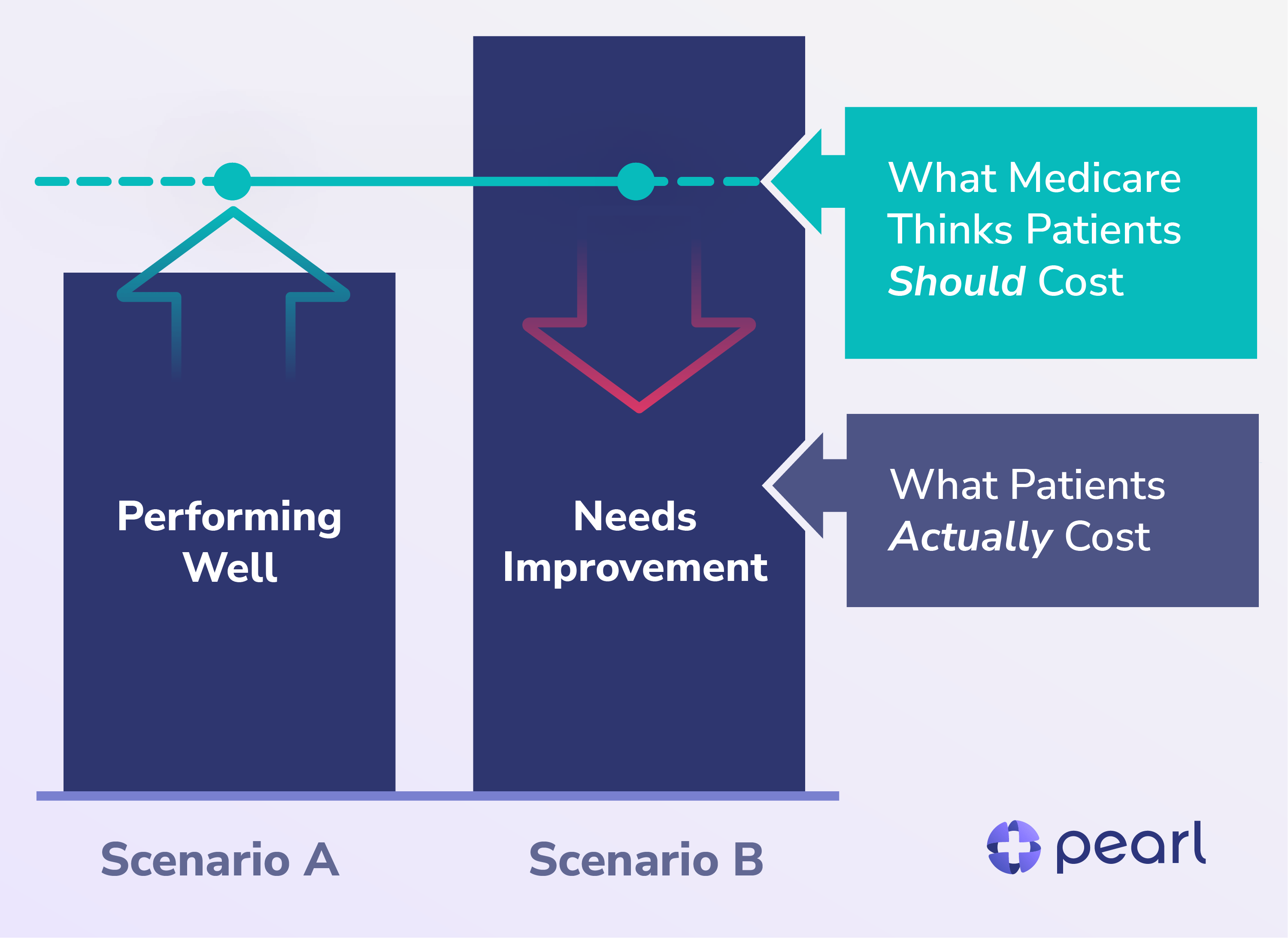

To optimize performance, ACOs must increase the delta between the benchmark and the TME. To do this, ACOs can either ensure the benchmark is not artificially low or decrease TME — or, ideally, both.

Improve Benchmark Accuracy

In REACH, an ACO can increase their benchmark up to 3% each year, which translates into an additional 3% savings. To appropriately capture an accurate benchmark, ACOs should focus on certain tactics:

- Risk Adjustment Training: Ensure all ACO providers are educated on the value of risk adjustment, complete compliance training, and learn how to properly document and capture codes when clinically appropriate.

- Annual Wellness Visits: Schedule and complete AWVs for aligned patients, as this presents an opportunity to capture appropriate codes, encourages claims-based alignment for future years, and presents an opportunity for voluntary alignment.

- Historic and Inferred Codes: Providers should clinically assess the patient to determine if historic codes are still applicable and identify any new conditions or diagnoses. ACOs can assist by surfacing historic codes that require reevaluation and through data science efforts to surface suspected codes (e.g., a patient who has received clinical lab results repeatedly indicating elevated A1C levels should be evaluated and potentially coded for diabetes).

Reduce Unnecessary Spend

Similar to other Medicare ACOs, reducing unnecessary utilization, such as admissions, readmissions, and post-acute care is the other method to generate shared savings. A few fundamental tactics that Pearl utilizes to reduce TME are:

- Real-time ADT Feeds: Providing Admission, Discharge, and Transfer (ADT) alerts seamlessly through our product within 15 minutes of an event allows our providers to track their patients’ journeys to ensure they get the right care at the right time.

- Curbside Consultations: Pearl’s product leverages an innovative curbside e-consult platform where PCPs gain access to a deep bench of specialists that provide virtual consults within 2 minutes of request at the point of care. This tool empowers PCPs to quickly inform their decisions and reduces unnecessary specialty visits and ER admissions, thereby saving the ACO, the government, and the patient money.

- ACO REACH Benefit Enhancements: CMMI offers many benefit enhancements (BEs) unique to the REACH model, such as Part B Cost Sharing (reduced or waived copays), SNF 3-Day Rule Waiver (appropriate early discharge from a hospital to a SNF), and the Telehealth waiver, as examples. Through these BEs, REACH allows for more innovative approaches to medicine by empowering providers to use their clinical judgment and circumvent outdated Medicare policies that limit patient engagement and experience.

ACO REACH presents a unique opportunity for primary care providers to maximize revenue from care provided to original Medicare patients, which enables them to reinvest in their patients, their staff, and their practices. As we continue to enable PCPs to participate and succeed in value-based care, we’ll share more in future posts on the economics of value-based care models and key levers for success.