Value-based care programs have never been simple, and Direct Contracting is no different. Nonetheless, understanding how Direct Contracting works is critical to succeeding in the model. In view of that, we’re going to break down one of the model’s central advantages: capitation. Capitation is the remittance to providers of a fixed reimbursement that is not tied to the volume of healthcare services provided, in lieu of fee-for-service (FFS) compensation.

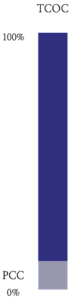

Before we dive into capitation, we need to understand the universe in which capitation exists — the denominator to capitation’s numerator: the total cost of care (TCOC). TCOC is just an industry term for how much providing healthcare services to a given patient is expected to cost in a specific year. In Direct Contracting, TCOC represents:

- all facility costs: for example, hospitals, skilled nursing facilities, outpatient ambulatory surgery facilities, etc.;

- all professional costs: for example, your annual primary care visit and any specialist visits; and

- any procedures: for example, lab tests, colonoscopies, surgeries, etc.

The one major healthcare bucket TCOC doesn’t include is prescription medications — except for medications administered in a doctor’s office (i.e., injectables and infusions), which providers generally bill as part of professional services.

We previously published an overview of how Medicare (CMS) calculates this number in the Direct Contracting model.

Concept 2: Base Primary Care Capitation (BPCC)

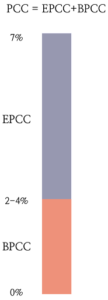

Base Primary Care Capitation (BPCC) is a monthly payment meant to represent the cost of providing primary care services to aligned beneficiaries. At a high level, BPCC is calculated by looking at the historical primary care services a primary care provider (PCP) rendered to these patients over a specific period of time (i.e., the ‘lookback period’), summing the cost of those services, and dividing by the number of beneficiaries aligned to a given provider. After some additional trending to account for healthcare inflation since the lookback period, we arrive at a per-member-per-month that CMS will remit to the Direct Contracting Entity (DCE) for each beneficiary aligned to the DCEs participating PCPs. This number generally ends up being about 2-4% of the TCOC.

While participating primary care providers do not need to convert 100% of their revenue from FFS to capitation, all providers Pearl assists in the Direct Contracting model are fully capitated. However, should a provider participate in a DCE and choose to take only a 50% FFS reduction (as an example), they would get half of the calculated BPCC and receive 50% of Medicare’s listed rates for any FFS claims they submit to CMS. PCPs participating in Direct Contracting can elect a 5-100% FFS reduction, and the BPCC will be calculated accordingly.

CMS also introduced the concept of an Enhanced Primary Care Capitation (EPCC) in the Direct Contracting model. The purpose of this payment is to enable DCEs to invest in tools and processes to help their member providers transition to value-based care best practices and better manage the health of beneficiaries aligned to the DCE. Unlike the BPCC, the EPCC must be repaid to CMS as part of the financial reconciliation process following each performance year.

While the BPCC is variable based on the actual historical cost of primary care services, the EPCC is elected by the DCE each performance year, and can be as much as 7% of the TCOC. Importantly, the EPCC is whatever is left over — so, if the BPCC ends up being 3% and the DCE elected a 7% EPCC, the actual EPCC is 4%.

While DCEs elect an EPCC amount that is inclusive of the BPCC (e.g. a DCE elects a 7% EPCC with CMS), we find it useful to think of these payments as exclusive, with the sum of them being the primary care capitation (PCC). In other words: PCC = EPCC + BPCC. This framework is helpful because they serve different purposes (BPCC is meant to reimburse primary care providers for the services they provide their beneficiaries, whereas EPCC is meant to fund investments by the DCE in care model transformations) and are treated differently by CMS (BPCC is a payment, whereas EPCC is effectively a zero-interest loan).

If a DCE has certain arrangements with specialists and facilities to be preferred providers within the DCE, it can secure a capitation payment from CMS beyond the PCC to pay these preferred providers a fixed monthly amount for their services. This is called the Advanced Payment Option (APO). The simplest way to think about the APO is as the ‘BPCC for specialists’; it’s just another per-member-per-month payment to a provider that is designed to be proportional to the cost of services the provider is expected to deliver to aligned beneficiaries in a given year, in exchange for forgoing FFS compensation

The size of the APO that a DCE will receive depends on the scope of services that will be provided by the specialists and facilities it has contracted as preferred providers: the larger the set of services that will be covered by the DCE in this way, the greater the APO the DCE can elect. As with participating providers, preferred providers can elect a 5-100% FFS reduction, and the size of the APO will also be adjusted by this decision.

Concept 5: Total Care Capitation (TCC)

The Direct Contracting model allows some DCEs to elect Total Care Capitation (TCC). The simplest way to think of this payment is as the full election of the maximum APO, representing a complete network of facilities and specialists that are being reimbursed 100% through capitation (i.e. all providers have elected a 100% FFS reduction).

TCC takes the entire TCOC and divides it by 12, creating a monthly capitation payment made to the DCE by CMS to cover all cost of services for beneficiaries that are being managed by the DCE. CMS does withhold a certain percentage of the TCOC for services not anticipated to be provided by DCE participating and preferred providers–essentially accounting for what the industry calls ‘leakage’ out of the DCEs defined network. Only some entities will be suitable candidates for properly administering TCC: they should have adequate networks to provide the full range of services their aligned beneficiaries will need (e.g. contracted hospitals, a wide range of specialists and ancillary services and primary care providers).

For more help unpacking how Medicare’s Direct Contracting model works, check out these resources. Follow Pearl Health on LinkedIn or Twitter for regular insights in your newsfeed.