Revised from July 11, 2022

Meeting PCPs Where They Are

“How do I know that you’re not like all the others,” the doctor asks, as she reviews an illustrative analysis of the financial opportunity that Pearl is offering to her practice. “We’ve been promised a lot over the years by ACOs and partners, and not a lot of those promises have been kept.”

“Let’s hear them out,” her partner, a primary care physician (PCP) with more than twenty years in practice, interjects. “The numbers look compelling.”

Practice staff walk in and out of the break room inside the Arizona office, which cares for nearly three thousand original Medicare patients, among thousands of others. A nurse practitioner stops to speak with one of the physicians who sits with us, bemoaning cumbersome quality measures reporting required for participation in the Medicare Shared Savings Program (MSSP).1 The doctor sighs, and quietly responds that they need to continue reporting the required quality measures.

As the Pearl team and I meet with primary care practices and groups across the country, a similar refrain often emerges. PCPs and their staff face a dizzying array of options, explicitly aimed at easing financial and operational burdens as they continue to deliver life-changing care to their patients. But the reality often falls well short of the promise.

When faced with risk-based arrangements, many PCPs tell us that they’ve already taken on risk to get where they are today. After all, they’ve spent years going to medical school, built up practices through hard work and entrepreneurial risk, and — in some cases — tried out previous programs and models from the Centers for Medicare and Medicaid Innovation (CMMI) to align financial incentives with their delivery of better quality care at a lower cost. Why should they have to take on more risk, they ask?

Beyond that, many providers have been burned — by contractually buried “gotchas,” opaque explanations of why there aren’t shared shavings despite positive individual performance, operational burdens imposed by heavy participation requirements, and fly-by-night partners who simply go out of business before delivering value.

As Pearl works to empower and enable PCPs, we’d lack empathy if we didn’t recognize that this is most PCPs’ starting point for transitioning to value. That’s why our team works hard to meet PCPs where they are — and to make it easy for them to start this journey with Pearl to pursue better outcomes for their patients, their staff, and themselves.

Understanding PCPs through Prospect Theory

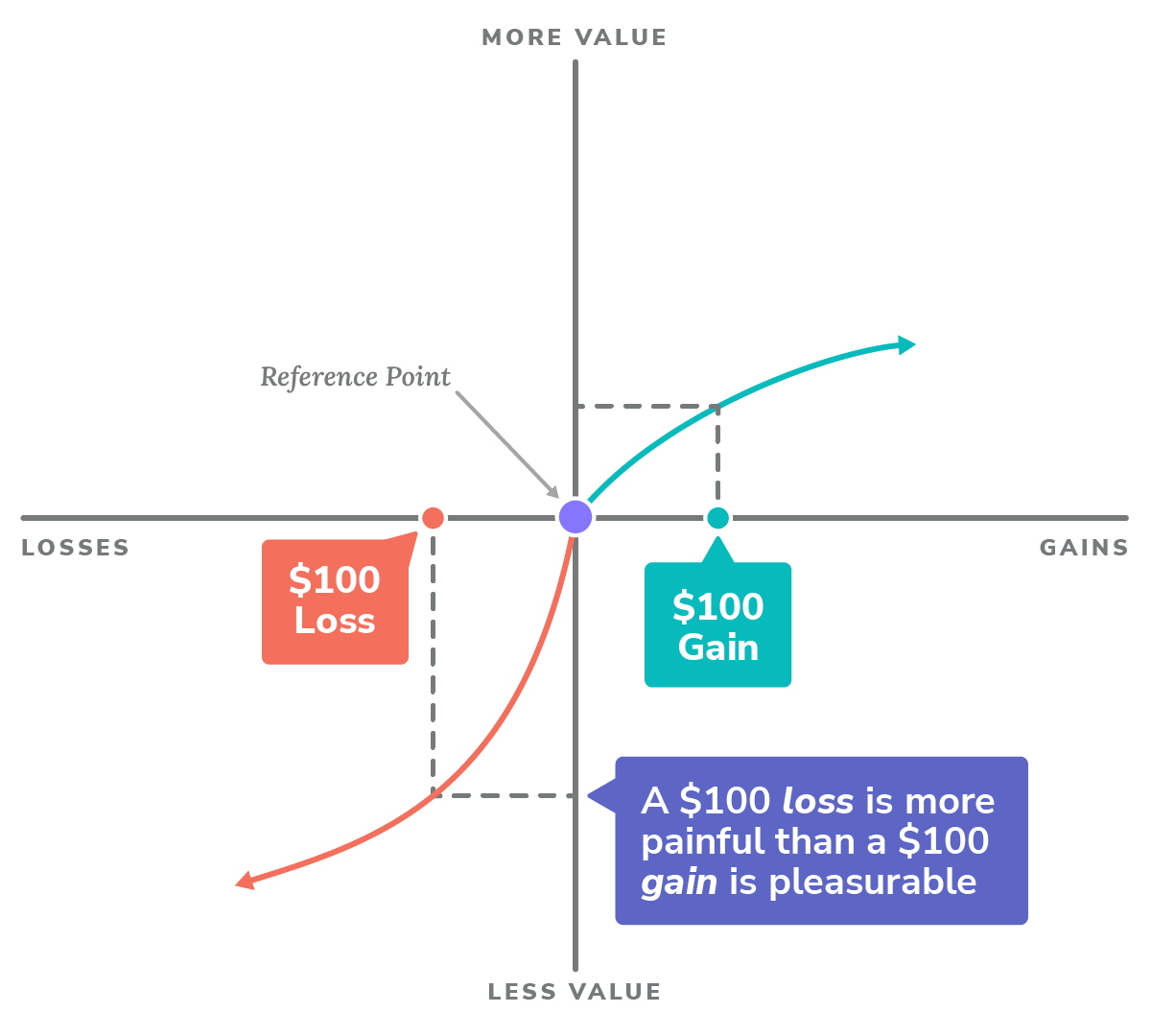

Roughly twenty years ago, Daniel Kahneman and Amos Tversky were awarded the Nobel Prize in economics for their work on Prospect Theory.2 They posited that, when making decisions, people use a reference point to frame the perceived value of potential gains or losses. This allows us to conceptualize how much pleasure we associate with gains — and how much pain we associate with losses.

For most people, the following patterns are typical:

- People are usually risk-averse when it comes to considering prospective gains. This means certain, smaller gains are often preferred to larger, uncertain gains.

- People are usually risk-prone when it comes to prospective losses. This means larger, uncertain losses are often preferred to smaller, certain losses.

Prospect Theory: Typical Valuation of Gains and Losses

Adapted from Daniel Kahneman and Amos Tversky, “Prospect Theory: An Analysis of Decision under Risk.” Econometrica, March 1979. Figure 3: A hypothetical value function.

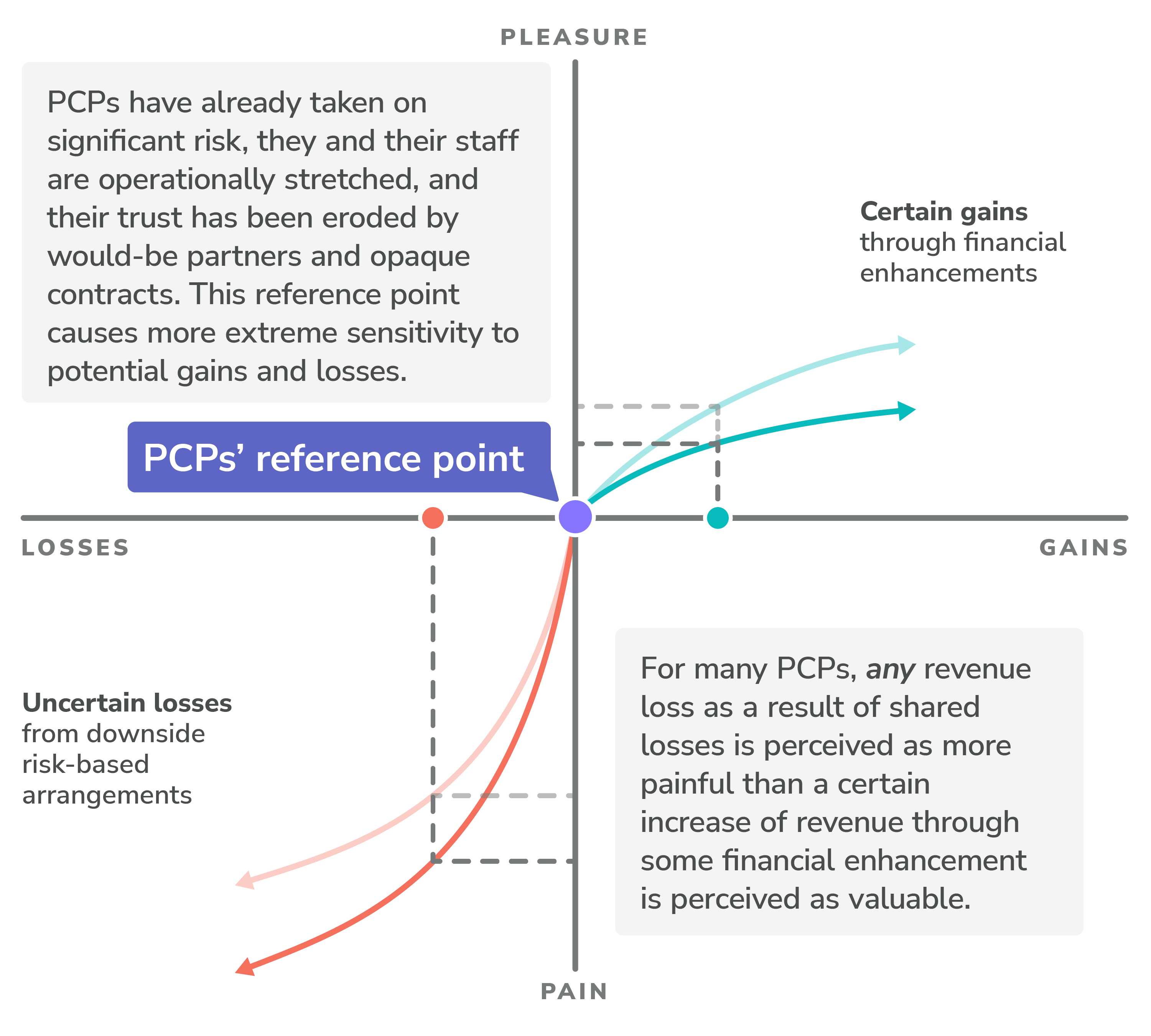

Considering the reference point I mentioned above, it likely comes as no surprise that doctors tend to be very risk-averse when it comes to both prospective gains and losses. In reality, in order for many PCPs to consider an alternative to their status quo, they often require certain, larger gains, coupled with the certainty of no loss. Although the pattern contours are similar to the norm, the sensitivity is much more extreme as a result of their reference point: any potential revenue loss as a result of shared losses is more painful, in many cases, than a certain increase of revenue through some financial enhancement.

Primary Care Practices: Typical Valuation of Gains and Losses

The good news? Pearl cares about primary care, and we’re willing to meet and support PCPs, wherever they are on the risk spectrum.

Supporting PCPs’ Medicare Revenue Maximization

In addition to helping our partner PCPs focus attention on the patients who need it most with no-cost software and services, we also help them maximize revenue from their care of traditional Medicare patients. Central to this is structuring and communicating financial options for partnering with Pearl and participation in Medicare’s ACO Reach model.

The Financial Keys to ACO REACH

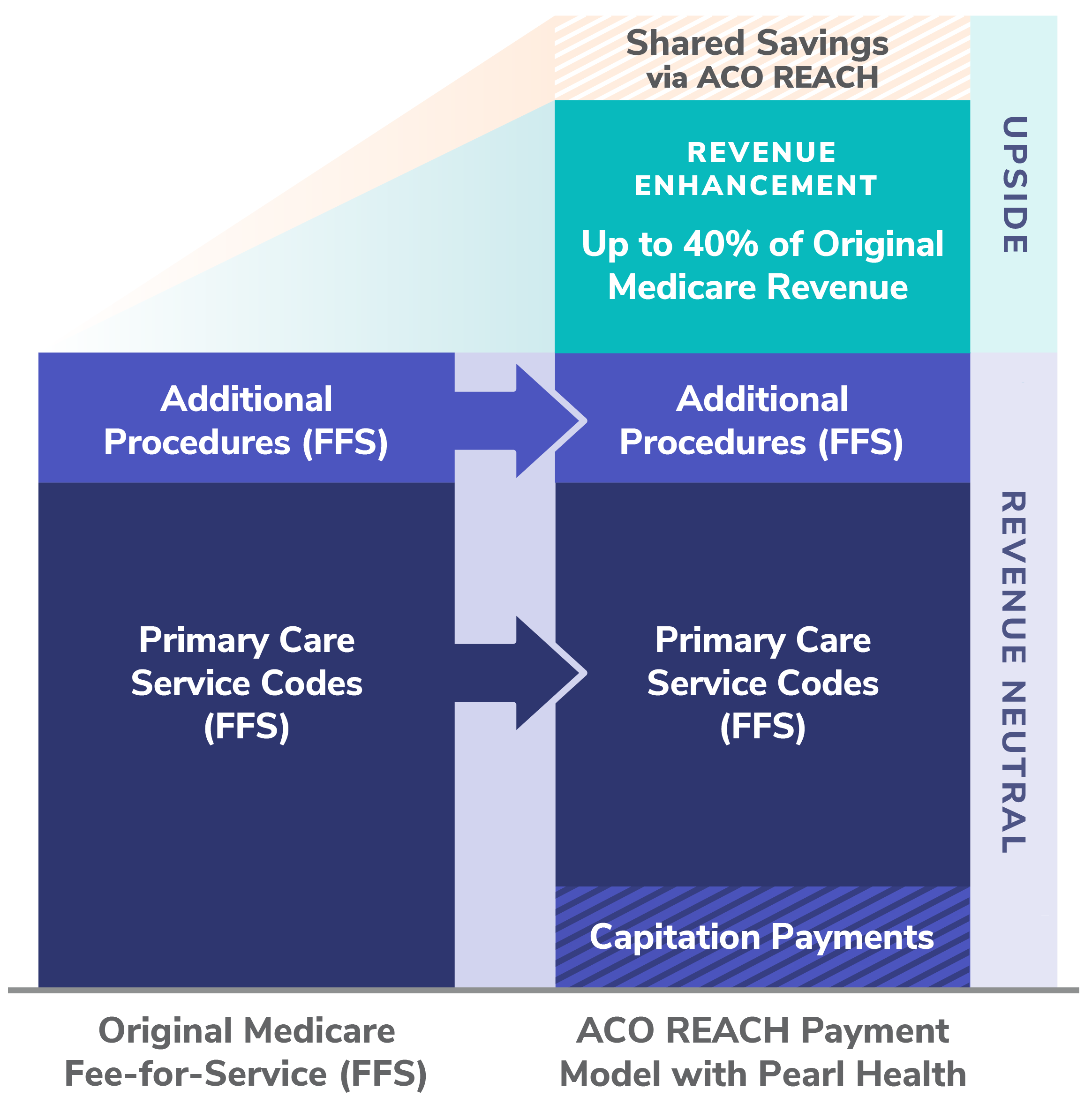

There are three key financial mechanisms that PCPs and their staff need to know about partnering with Pearl under Medicare’s ACO REACH model:

- Shifting to capitation from fee-for-service (FFS) payments;

- Entering into risk-based arrangements; and

- Revenue Enhancements that guarantee improved revenues over FFS.

Primary Care Capitation (PCC)

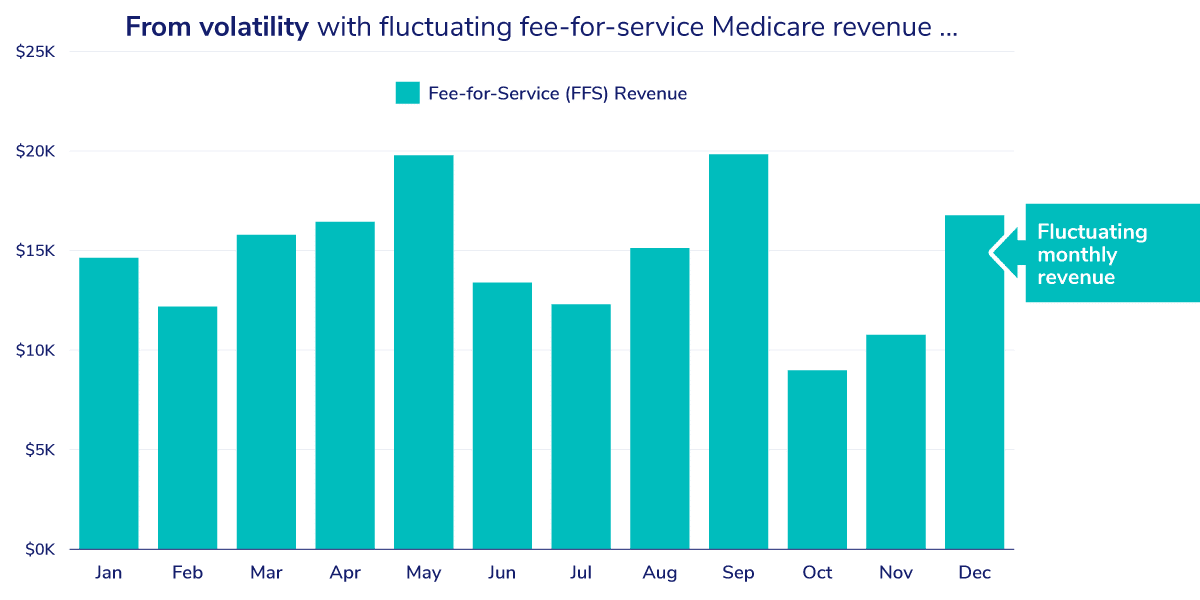

Under the ACO REACH model, Primary Care Capitation (PCC) gives PCPs financial freedom, enabling autonomy to deliver care to traditional Medicare patients as they see fit.

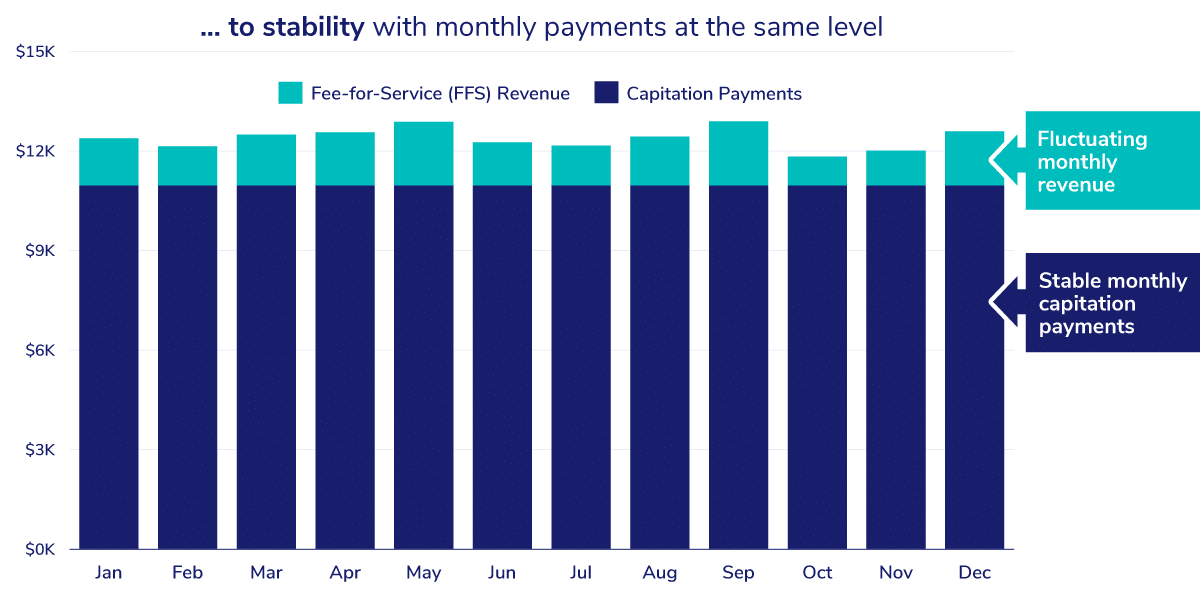

PCC does this by transforming PCPs’ compensation model — in a revenue-neutral way — from volume-based payments for the number of primary care services they provide to stable, monthly payments for revenue CMS estimates the provider would otherwise make from her Medicare patient panel.

CMS calculates monthly PCC payments by indexing payments received under FFS in previous years and dividing the number by 12, the number of months in a year. PCC is designed to provide stable, revenue-neutral payments for Evaluation and Management (PQEM) billing codes (for more detail, read An Introduction to Capitation in Medicare’s Direct Contracting Model).

Operationally, practices continue to submit claims for all services as they otherwise would, but payment for claims under the PQEM (aka E&M) codes below will be reduced in accordance with a FFS Fee Reduction Agreement, in exchange for these capitation payments.3

Most commonly used E&M services and billing codes

For the upcoming 2024 performance year, providers who participate in the ACO REACH model must receive, at minimum, 20% of their payments for primary care services in the form of capitation payments. This is coupled with a mirrored 20% Fee Reduction in FFS payments.4

Primary Care Capitation Requirements

As mentioned, PCC payments keep revenue from primary care services neutral, while changing how the revenue comes in — and the ways PCPs are encouraged, by incentives, to deliver care. Rather than focusing on how many visits can be jammed into a single day, PCPs have autonomy to deliver care — and allocate their time and resources — as they see fit.

Pearl supports PCPs on their transition to capitation from FFS, offering support of the minimum required fee reduction under the ACO REACH model, all the way up to 100% capitation for primary care services.

Risk-Based Arrangements

Some providers laugh when posed with the statement that “risk” isn’t a four-letter word — many don’t. Bad jokes aside, ACO REACH, like some of its value-based predecessors, offers PCPs an opportunity to take a bet on themselves and, more specifically, on their ability to deliver better quality care at a lower cost.

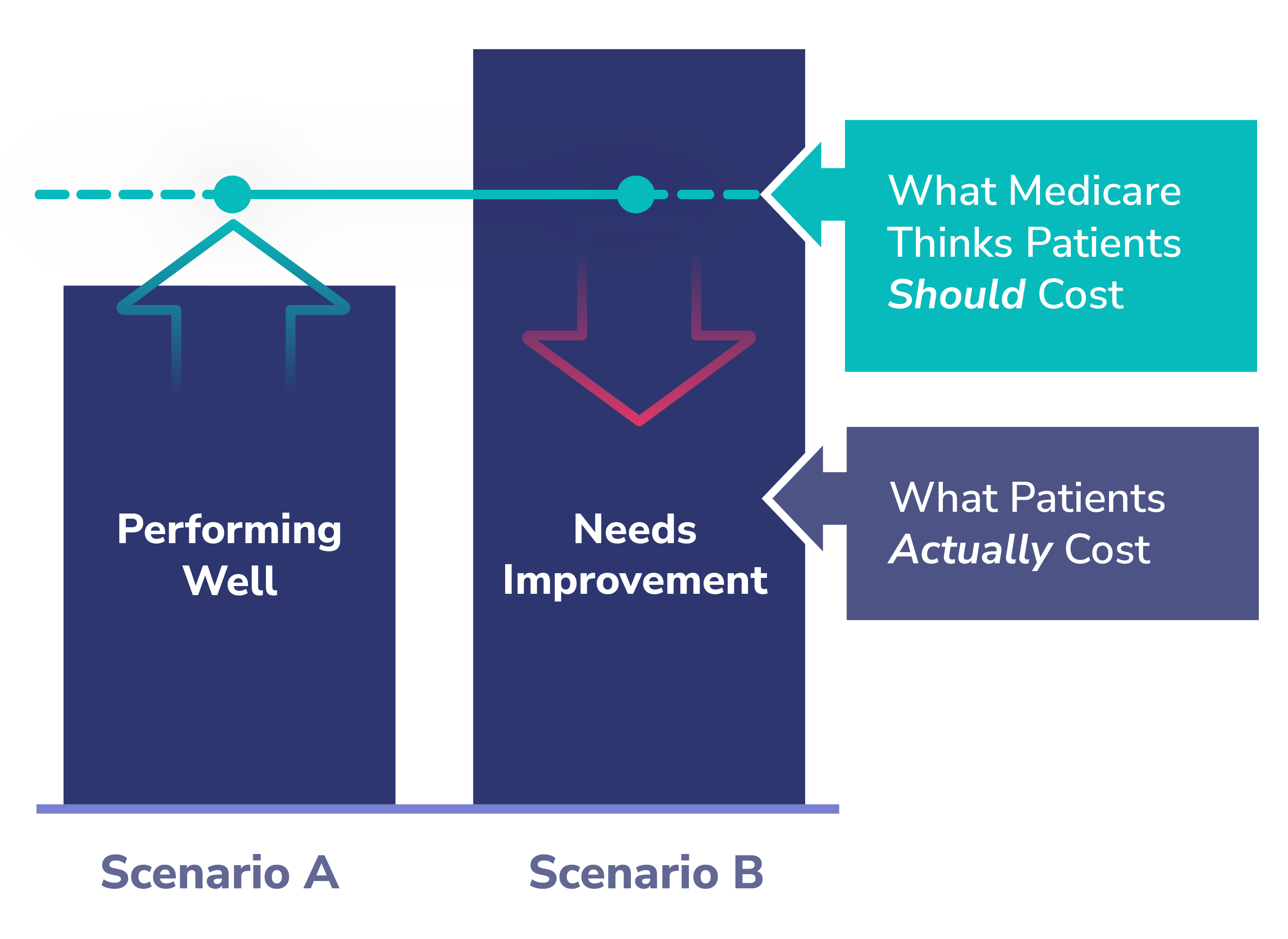

At a high level, Medicare establishes a benchmark for PCPs under the ACO REACH model based on historical claims data, factoring in typical regional costs, the projected level of care needed for a given patient panel, and the trend of inflation in healthcare costs, among other factors (for more detail, watch this tutorial on Direct Contacting Benchmarks). This benchmark is basically how much Medicare believes it should cost to deliver primary care services for a typical patient in a given practice’s patient panel.

In value-based risk arrangements like ones supported under the ACO REACH model, PCPs and their practices must deliver care at a lower cost than the benchmark to generate savings. In contrast, if they deliver care at a cost greater than the benchmark, this results in losses. These losses can be shared, both by Medicare and partners like Pearl.

Pearl helps PCPs enter into risk-based arrangements by taking on asymmetric risk on their behalf — in some cases, supporting no-downside risk arrangements, while going in as 50-50 partners for those practices ready and willing to take on risk. We do this in exchange for portions of the shared savings that we believe PCPs will generate by leveraging our software and services to help them beat the benchmark.

Shared savings is currently the primary way that Pearl generates revenue for itself... We only make money when our partner primary care practices and groups succeed. Their success is our success.

Shared savings is currently the primary way that Pearl generates revenue for itself — a fact that we hope inspires confidence in our commitment to partnering with PCPs. We only make money when our partner primary care practices and groups succeed. Their success is our success.

Revenue Enhancements: Improving Revenue vs. Fee-for-Service

Through June 15th, we’re currently offering PCPs contracts with a Revenue Enhancement of up to 50% more revenue for qualifying practices. We’re offering this enhancement in addition to shared savings that practices could earn by choosing Pearl to help them succeed in ACO REACH value-based arrangements.

The exact way the Pearl Revenue Enhancement is calculated depends on how much capitation a given PCP or group decides is right for their ACO REACH arrangement with Pearl.

In either case, the enhancement amounts to an effective increase of up to 50% more than what a practice or group would otherwise make from FFS payments. All enhancements are paid out as monthly payments, alongside capitation payments, and depend on a practice or group remaining in contract with Pearl for the duration of a given Performance Year to which the enhancement applies.

We sometimes get the question from providers: “How can you offer financing like this?” The simple answer is that Pearl is investing in the long haul. Pearl cares about primary care, and we aim to make it easy for PCPs to transition to value, starting with ACO REACH.

More pragmatically, we believe in our ability to earn PCPs’ trust and business year over year, for years to come. We’re confident that, over time, we’ll help PCPs unlock, see, and participate in the financial opportunity of shared savings. To start, though, we’re willing to make the first step easy with certain gains and minimal losses.

Interested in connecting to learn how Pearl can help your primary care practice or group? Feel free to drop me an email or connect with me on LinkedIn.

- MSSP ACOs require reporting on 33 quality measures; MIPS calls for reporting on up to 200 quality measures. In contrast, ACO REACH has only 4 quality measures, three of which are claims-based and one of which is a CAHPS survey, which Pearl administers on its partner practices’ behalf. For more information, see Reach for Simplicity: How ACO REACH Makes Quality Measurement Easy.

- Daniel Kahneman and Amos Tversky’s work on Prospect Theory was groundbreaking, applying psychological insights to economic theory, especially areas of judgment and decision-making under certainty. For more information, read Prospect Theory: An Analysis of Decision under Risk (Mar., 1979).

- For more detail about Direct Contracting — now known as the ACO REACH model — see pages 23-25 of “Direct Contracting (Professional and Global) Frequently Asked Questions.“

- For more detail, see page 43 of the “ACO Realizing Equity, Access, and Community Health (REACH) Model Request for Applications” document.