Key Points

- While CMS’ ACO REACH Model presents an opportunity for PCPs to capture more revenue for value they may already be creating, every practice is different and there is no one-size-fits-all approach to program participation.

- Lacking analytics capabilities and know-how can make options for participating seem overly complicated and potential risks and rewards opaque, even for large groups.

- For small- and medium-sized practices, the lack of transparency can prevent potentially high-performing practices from participating altogether, as they often lack the capital reserves necessary to feel comfortable participating in risk-bearing models and may not understand the zero-risk options available to them.

- Pearl Health’s Value-Based Care Advisor makes it easy for you to understand your options for participating in ACO REACH as a PCP, offers guidance on how to adjust your risk tolerance, and gives you simple visibility into the potential financial implications for your practice.

PCPs need financial transparency and choice to participate in ACO REACH

As a PCP interested in value-based care, how can you make a decision about whether to participate in ACO REACH without understanding your options and the potential financial implications for your practice?

As the health care system transitions from fee-for-service to value-based payment arrangements, there is an enormous opportunity for both large and small primary care practices to increase revenue from effectively delivering quality patient care at a lower cost.

However, there are key differences between practices — from region to patient panel to historical performance to financial position — that make one-size-fits-all approaches to program participation unreasonable. Further, without sophisticated analytics and/or subject-matter expertise in value-based care, practices often find it difficult to ascertain whether programs like ACO REACH make sense for them financially.

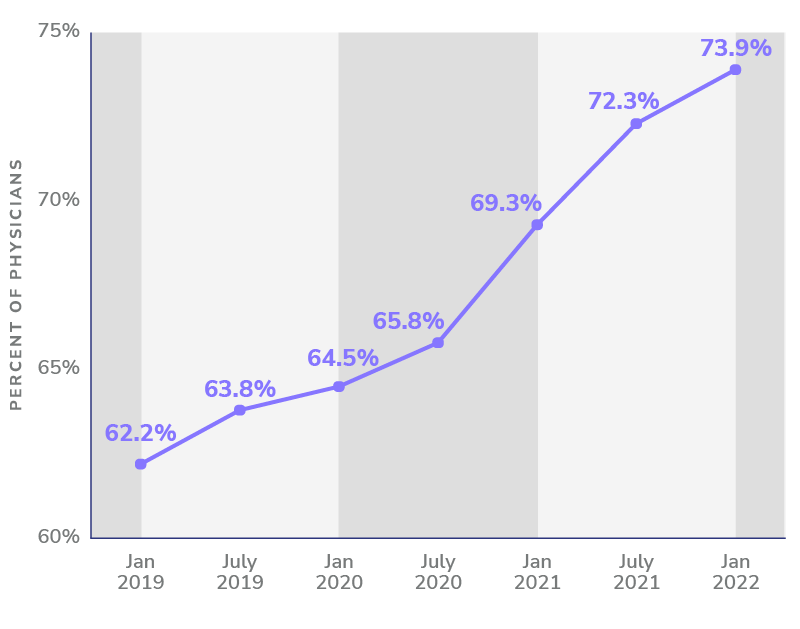

The lack of transparency into program participation options can be especially problematic for small- and medium-sized practices, for whom the opportunity to increase revenue could be particularly impactful. Survey findings suggest that small independents value their autonomy but face increasing financial pressure, which can be existential for their practices;1 this is further evidenced by the rapidly increasing proportion of physicians employed by hospitals, health systems, or corporate entities.2

Percent of U.S. Physicians Employed by Hospitals or Corporate Entities in 2019–2021

Adapted from “COVID-19’s Impact On Acquisitions of Physician Practices and Physician Employment 2019-2021.” Physicians Advocacy Institute, April 2022.

Data suggests that small independents are uniquely positioned to succeed in these new payment arrangements.

It makes sense that independent practices with limited cash on hand and increasing financial pressure are often naturally risk averse, making participation in new risk-bearing, value-based payment models like ACO REACH seem untenable — even with the potential for upside.3

Paradoxically, data suggests that small independents may be uniquely positioned to succeed in these new payment arrangements and lead the transition to value-based care.4

- Small independents are shown to be no less likely than employed physicians to understand the mechanics of how to perform well in value-based payment arrangements.5

- On average, they are shown to have fewer preventable hospital admissions than larger practices.6

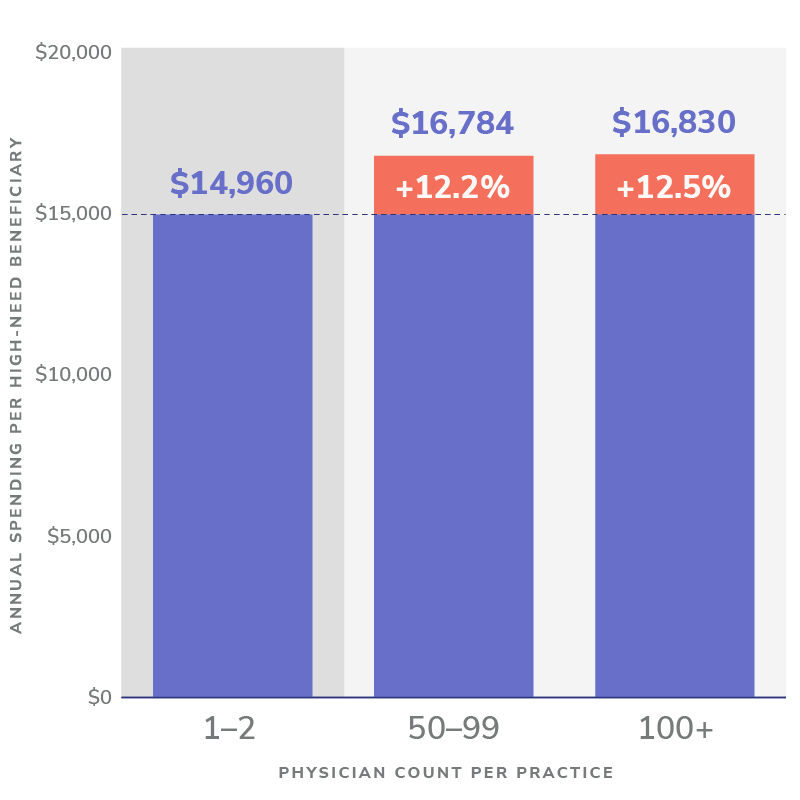

- They are shown to spend less on average per Medicare patient, especially for high-need beneficiaries, with no significant differences in patient outcomes.7

Average Annual Spending per High-Need Beneficiary by Physician Count per Practice

Source: Lawrence Caslino, et al. “Medical Group Characteristics and the Cost and Quality of Care for Medicare Beneficiaries.” Table 4: Multivariable Analysis of Practice Characteristics and Medicare Spending.

In short, while ACO REACH presents an opportunity for independent practices to capture more revenue for value they are often already creating in caring for high-need Medicare beneficiaries, lacking capital reserves can make downside risk unbearable, and lacking analytics capabilities and know-how can make the potential risks and rewards opaque

The Value-Based Care Advisor: Financial Transparency and Choice for ACO REACH

That’s why Pearl Health created our Value-Based Care Advisor. This user-friendly tool was purpose-built to demystify participation in ACO REACH, using world-class analytics to provide transparency into your options for program participation. The tool also offers guidance on how you can adjust your risk tolerance, as well as information about potential financial implications across scenarios.

How much more could your practice earn with Pearl?

Pearl Health takes on asymmetric risk on your behalf and enables you to balance the potential upside and downside based on your practice’s comfort level. If you are not comfortable taking on any downside risk and want to test your way into the model, we’ll take on the risk for you and guarantee your practice increased revenue as you get started; conversely, if you are comfortable in value-based payment arrangements already and would prefer to take on more risk in exchange for greater potential shared savings, we have partnership options to help you make the most of the opportunity. In all cases, our revenue model is a true partnership — we only succeed if you succeed.

Our vision is to use analytics to draw actionable insights from data that enable you to provide higher-quality care for your patients and optimize performance for your practice — to help you automate the transition to value. However, we know that it all starts with making educated decisions about how to enter into value-based payment arrangements to begin with, understanding the mechanics of the model, assessing potential performance, and maximizing potential upside while mitigating risk.

At Pearl, we understand how important transparency is for physicians who are considering participation in ACO REACH. The Value-Based Care Advisor is just one more way that we’re using our analytics capabilities, technology, and know-how to lower the barrier to entry for independent primary care providers and to empower them to lead the transition to value in primary care.

- Kyle Gibler, et al. “Physician Employment: The Path Forward in the COVID-19 Era.” McKinsey & Company, McKinsey & Company, 17 July 2020.

- “COVID-19’s Impact On Acquisitions of Physician Practices and Physician Employment 2019-2021.” Prepared by Avalere Health, Physicians Advocacy Institute, April 2022.

- Gibler. “Physician Employment: The Path Forward in the COVID-19 Era.”

- Farzad Mostashari. “The Paradox of Size: How Small, Independent Practices Can Thrive in Value-Based Care.” Annals of Family Medicine, American Academy of Family Physicians, January 2016.

- Gibler, “Physician Employment: The Path Forward in the COVID-19 Era.”

- Lawrence Casalino, et al. “Small Primary Care Physician Practices Have Low Rates of Preventable Hospital Admissions.” Health Affairs (Project Hope), U.S. National Library of Medicine, September 2014.

- Lawrence Caslino, et al. “Medical Group Characteristics and the Cost and Quality of Care for Medicare Beneficiaries.” Health Research and Education Trust, U.S. National Library of Medicine, December 2018.