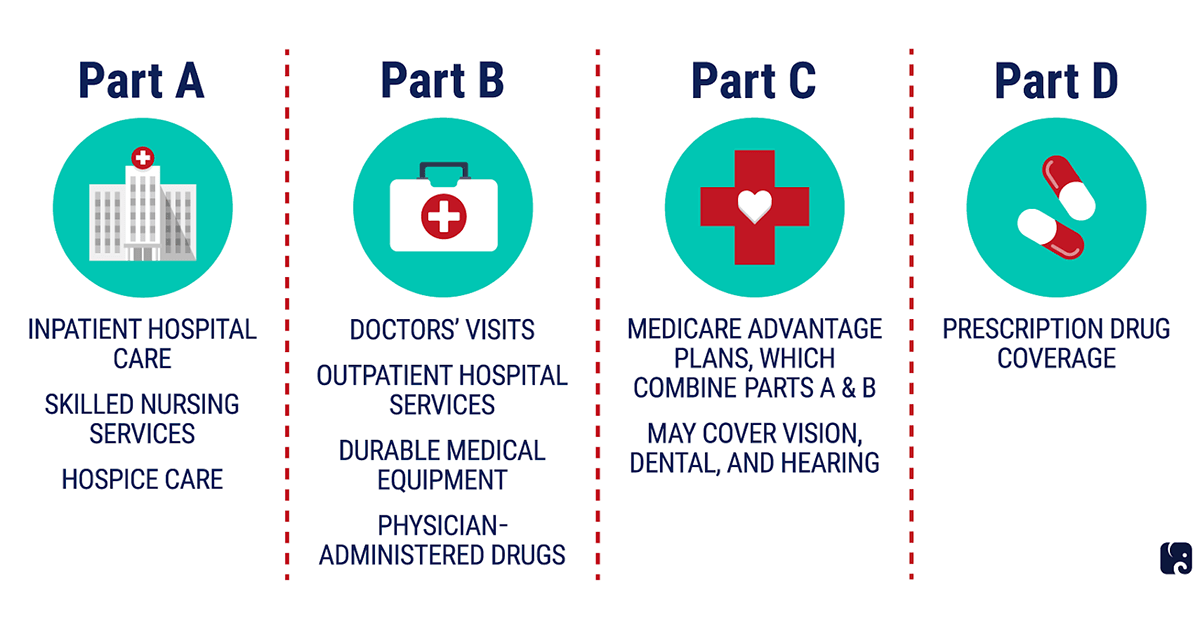

Medicare is the health coverage program administered by the Centers for Medicare and Medicaid Services (CMS). This program uses public funds to pay for care, is widely accepted and can be broken down into four main parts:

Under Traditional Medicare, the federal government pre-fixes the premiums, deductibles, and copays for both Parts A and B. For Part D, the national government sets the maximum deductible for drug costs, yet the copay fluctuates between plans. The limit to what a person can spend on healthcare in a year is wholly dependent on how frequently they access care–the annual cost is uncapped. Traditional Medicare covers most medically necessary services offered by hospitals and physicians, but lacks coverage for drug costs or services such as dental, optical, and fitness programs.

The introduction of Medicare Advantage (MA) plans (also known as Medicare Part C) granted beneficiaries the option to access coverage through private markets. These plans cover all the services one would get under Traditional Medicare, and many cover additional medical services such as dental, optical, or fitness programs. If one opts in to a Medicare Advantage plan, she still retains Medicare eligibility, but the government hands over responsibility for managing her coverage and benefits to a private MA plan.

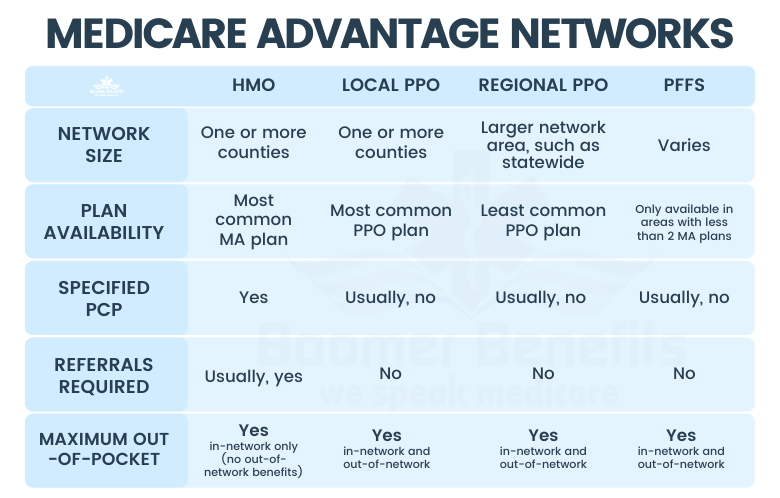

Medicare pays MA plans a fixed amount each month to cover the costs of managing the benefits of their MA beneficiaries. These plans are categorized by the type of insurer issuing the plan: Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Private Fee-for-Service (PFFS). These plans, which vary by drug costs (and coverage), premiums, provider networks, copays and deductibles, are required to set a yearly limit to what beneficiaries can pay for care. Any charges incurred beyond this limit are fully covered by the plan. For many, Medicare Advantage plans are a cheaper option featuring lower out-of-pocket costs than Traditional Medicare. The yearly limit functions as a safety net for individuals who anticipate needing extensive or intensive care, although CMS allows insurers to set that limit and change it each year.

Though the yearly limit is meant to protect beneficiaries from extraordinary costs, beneficiaries have less freedom to access care than in Traditional Medicare: private MA plans employ mechanisms to disincentivize utilization of out-of-network coverage, high-cost treatment or expensive medications. For instance, the most common MA plans (HMOs) use heavy-handed sticks, such as no-referral penalties, or denial of coverage for out-of-network care, as mechanisms to keep costs low.

In addition to network and referral requirements, MA plans apply burdensome gating mechanisms to defray care costs: with prior authorization and utilization management requirements, doctors are forced to spend time convincing MA plans that a certain medication or procedure is medically necessary. Though a patient can sidestep these requirements in the case of an emergency, waiting for emergent events to arise before receiving necessary care is a problematic hallmark of the US healthcare system–and one that increases costs for all.

Studies show that a disproportionate amount of our healthcare dollars are being spent on patients within the last 30 days of their life. This truth is a reflection of a system that conceives of healthcare as a reactive treatment in response to declining health. Plans such as those described above–which make it more difficult for providers/patients to access the wealth of healthcare resources before an emergency occurs–serve to perpetuate this system of reactive, rather than proactive, care. Despite being marketed as an alternative to Traditional Medicare that features more comprehensive coverage, MA plans can therefore result in inadequate preventive care.

While studies show that MA plans are moving away from narrow networks, there is still an inherent problem of misaligned incentivization–namely volume-oriented fee-for-service reimbursement. In this MA fee-for-service framework, the incentives of Primary Care Providers (PCPs) and insurance plans are misaligned. On the one hand, doctors are incentivized to provide more (and more expensive) care in order to bring in more revenue. On the other hand, MA plans strive to keep total care costs low, so they employ tactics to disincentivize care delivery. This system of competing incentives predictably leads to a frustrating experience for doctors and beneficiaries who are often in a confrontational dynamic with their plan.

Enter Direct Contracting, which builds on lessons learned from Medicare Advantage, as well as previous value-based initiatives put forth by Medicare to address the shortcomings of these other programs and maintain access to high quality care while reducing costs. Direct Contracting Entities (DCEs) are constructs of providers (similar to ACOs) that group together to provide better care and benefits to Traditional Medicare beneficiaries. Under Direct Contracting, PCPs receive recurring monthly payments (capitation), proportional to the size and disease burden of their patient panel, for delivering primary care services to their Medicare beneficiaries. These payments are regional- and risk-adjusted (the mechanism by which Medicare reflects the healthiness or sickness of a beneficiary) to reflect the anticipated cost-of-care for beneficiaries. Depending on whether a beneficiary’s total care costs surpass or undershoot a target cost-of-care set by CMS each year, PCPs and their Direct Contracting Entities (DCEs) will share in the potential savings or losses generated from such care.

We at Pearl believe Direct Contracting is a preferable alternative to MA or vanilla Traditional Medicare because:

- Providers can directly share in the benefits of the value they create without relying on a private health plan.

- Providers can take on a number of risk-sharing configurations according to the physician’s financial needs, risk tolerance, and ability to direct patient care.

- Providers are incentivized to deploy high quality care responsibly, not generate volume.

- Direct Contracting emphasizes primary care as the nexus to overall positive health outcomes.

- Unlike in MA, beneficiaries retain their ability to see any provider who accepts Medicare, but beneficiaries can also receive many of the incentives previously only available to MA enrollees.

- There are no referral requirements, but beneficiaries are incentivized to follow the care plans laid out by their PCPs.

If you are interested in learning more about Direct Contracting, check out our Provider Walkthrough or our Frequently Asked Questions.